Ethereum ETFs break 8-day outflow streak, but ETH price fails to reclaim $2,800

Ethereum spot ETFs recorded $55.71 million in net inflows on November 21, breaking an eight-day outflow streak.

- Ethereum ETFs ended an eight-day outflow streak with $55.71M in net inflows.

- Fidelity’s FETH drove recovery with $95.4M inflows while BlackRock saw $53.7M out.

- ETH price stayed below $2,800, down 12.9% weekly and 28.9% over the past month.

Fidelity’s FETH led the inflows with $95.40 million, while BlackRock’s ETHA posted $53.68 million in outflows, partially offsetting the gains.

The ETF inflows failed to lift the Ethereum ( ETH ) price above $2,800. ETH has dropped 12.9% over the past seven days and 28.9% over the past 30 days. The token has also fallen 18.4% over the past year.

Fidelity drives ETF recovery after $1.3B in outflows

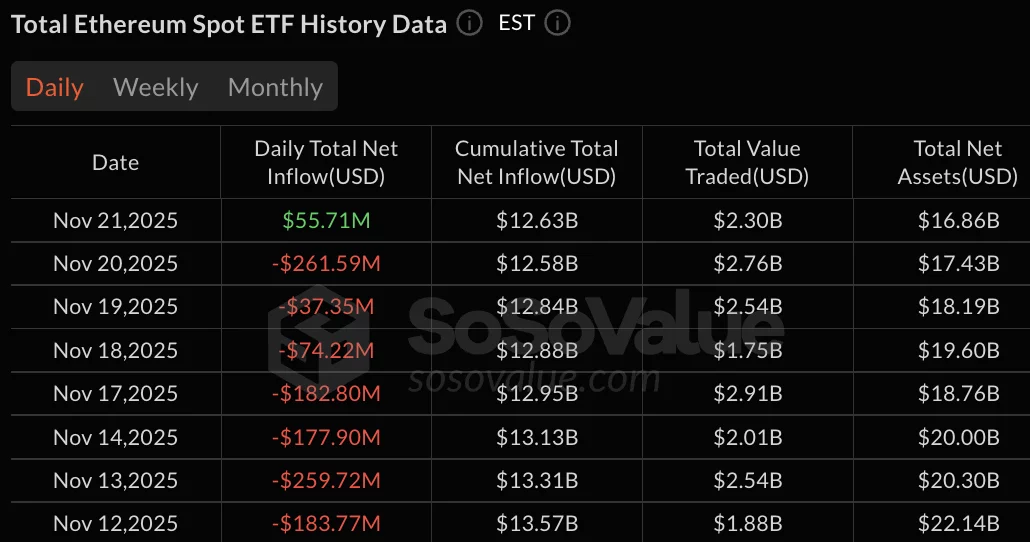

Ethereum ETFs bled $1.3 billion between November 11 and November 20. November 20 recorded the largest single-day withdrawal at $261.59 million, followed by $259.72 million on November 13 and $182.80 million on November 17.

BlackRock’s ETHA continued seeing redemptions on November 21 with $53.68 million in outflows. The fund maintains cumulative net inflows of $12.89 billion.

Ethereum ETF data: SoSo Value

Ethereum ETF data: SoSo Value

Fidelity’s FETH attracted $95.40 million on November 21. Cumulative net inflows for FETH reached $2.54 billion.

Grayscale’s ETH mini trust recorded $7.73 million in inflows, bringing its total to $1.42 billion. Bitwise’s ETHW saw $6.26 million in inflows, with cumulative assets hitting $399.30 million.

Grayscale’s ETHE, VanEck’s ETHV, Franklin’s EZET, 21Shares’ TETH, and Invesco’s QETH all posted zero flow activity on November 21.

Total net assets under management for ETH ETFs stood at $16.86 billion as of November 21.

Cumulative total net inflow across all ETH ETFs reached $12.63 billion. Total value traded hit $2.30 billion on November 21, down from $2.76 billion the previous day.

ETH price struggles amid overall market weakness

Ethereum price has underperformed Bitcoin ( BTC ) and other major cryptocurrencies over the past month. The 28.9% decline over 30 days contrasts with Bitcoin’s modest pullback during the same period.

Ethereum 7D-price: CoinGecko

Ethereum 7D-price: CoinGecko

The ETF inflows on November 21 came after eight consecutive days of redemptions totaling over $1.3 billion. The outflow streak began on November 11 with $107.18 million in withdrawals.

November 17 and November 20 recorded the steepest sell-offs. The $182.80 million outflow on November 17 was followed by $261.59 million in redemptions on November 20.

ETH failed to reclaim the $2,800 level following the ETF inflows. The token’s 14-day performance shows a 19.4% drop, suggesting selling pressure has risen in recent weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ATOM rises 1.87% over 24 hours as network enhancements and governance proposals unfold

- ATOM rose 1.87% in 24 hours amid Cosmos' Iris-5 upgrade, introducing improved staking and cross-chain features despite 1-year 58.63% decline. - Three governance proposals aim to reallocate inflation funds to developer grants and boost validator incentives, with above-average community voting participation. - Ecosystem growth accelerates with new dApps and a cross-chain stablecoin aggregator, signaling maturing infrastructure and real-world use cases. - Analysts caution short-term volatility persists due

LTC Properties Rises 1.91% Over 24 Hours as Portfolio Adjusts and Dividends Remain Steady

- LTC Properties boosted Q3 earnings with portfolio rebalancing and 80% dividend payout ratio, ensuring monthly dividend coverage despite macroeconomic challenges. - 2025 guidance raised to $2.70-$2.83/share FFO range, reflecting $124.53M-$130.53M in total value as LTC prioritizes seniors housing over skilled nursing assets. - $270M invested in seniors housing portfolio (85% of $460M target), including a 7% yield acquisition, signaling strategic shift to stable income-generating properties. - Long-term deb

Elvis-Inspired Judge Steps Down Following Conduct Issues That Raise Questions About Fairness

- Missouri Judge Matthew Thornhill resigned after disciplinary commission found his Elvis-themed courtroom antics violated judicial conduct standards. - He admitted to wearing Elvis wigs, playing music, and making irrelevant references during proceedings, undermining courtroom solemnity. - His resignation includes a six-month unpaid suspension and 18-month reduced role before permanent departure, following prior 2008 misconduct. - Critics argue his actions eroded judicial impartiality, while Thornhill clai

Analyst Sets a Bold Bull Target for ETH at $12,000 in the Next 2-3 Years