Solana News Update: Crypto Markets Rally and Volatility Rises Following Fed's Dovish Shift Ahead of December Decision

- JPMorgan predicts a 25-basis-point Fed rate cut in December 2025, aligning with 79% market probability via CME FedWatch. - Dovish policy sparks crypto surge: Bitcoin hit $107,000 as lower rates reduce holding costs for non-yielding assets. - Trump-aligned economist Kevin Hassett's potential Fed chair nomination could boost crypto-friendly regulatory approaches. - Market sectors react diversely: tech stocks and fintech gain from cheaper capital, while traditional banks face margin compression. - December

JPMorgan Chase & Co. has strengthened its projection that the Federal Reserve will lower interest rates in December 2025, pointing to a more dovish policy approach and weakening economic data. The bank’s outlook is in step with increasing market confidence, with

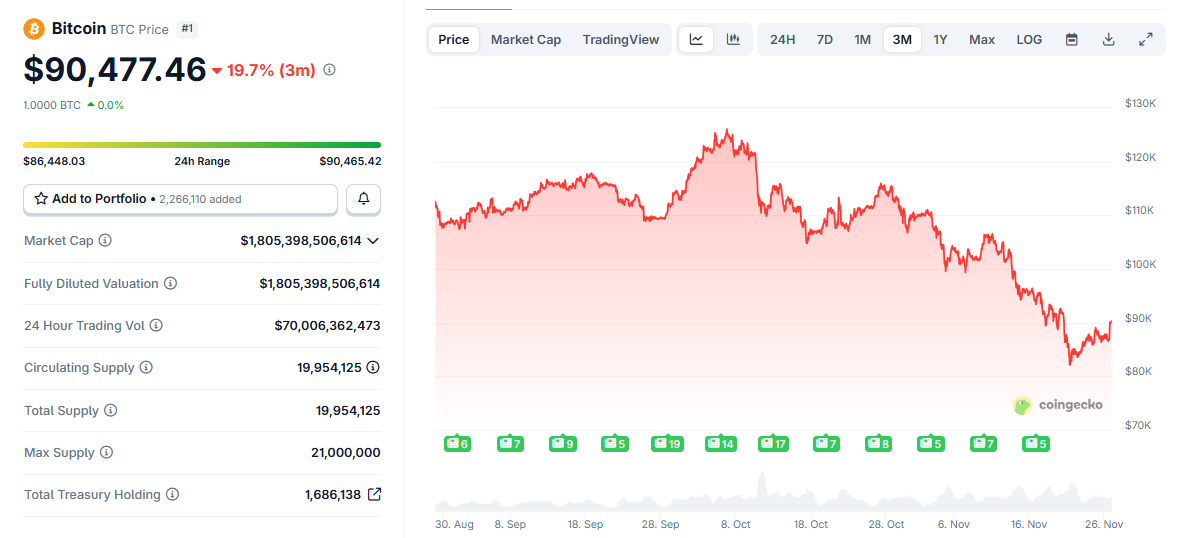

The shift toward looser monetary policy has already triggered a "risk-on" sentiment, with digital assets rallying as investors expect greater liquidity.

Hassett, who currently leads the White House National Economic Council, is a top contender to succeed Fed Chair Jerome Powell,

Markets have broadly responded to the prospect of rate cuts.

JPMorgan’s report identifies which sectors could benefit or suffer from a rate reduction.

Looking forward, the Fed’s meeting on December 9–10 will be pivotal. Although a 25-basis-point cut is widely anticipated,

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Are Digital Asset Treasuries (DATs) Just a Fading Fad?

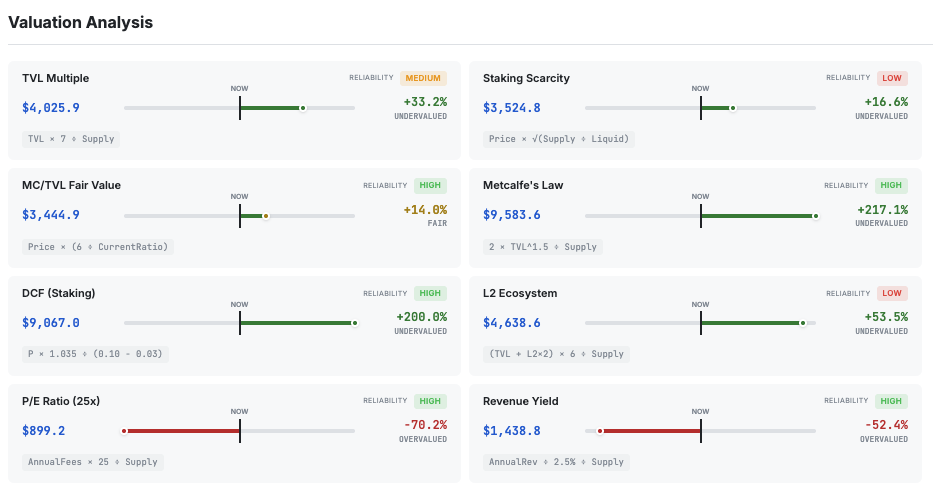

Hashed’s Simon Kim Says Ethereum Is 57% Undervalued

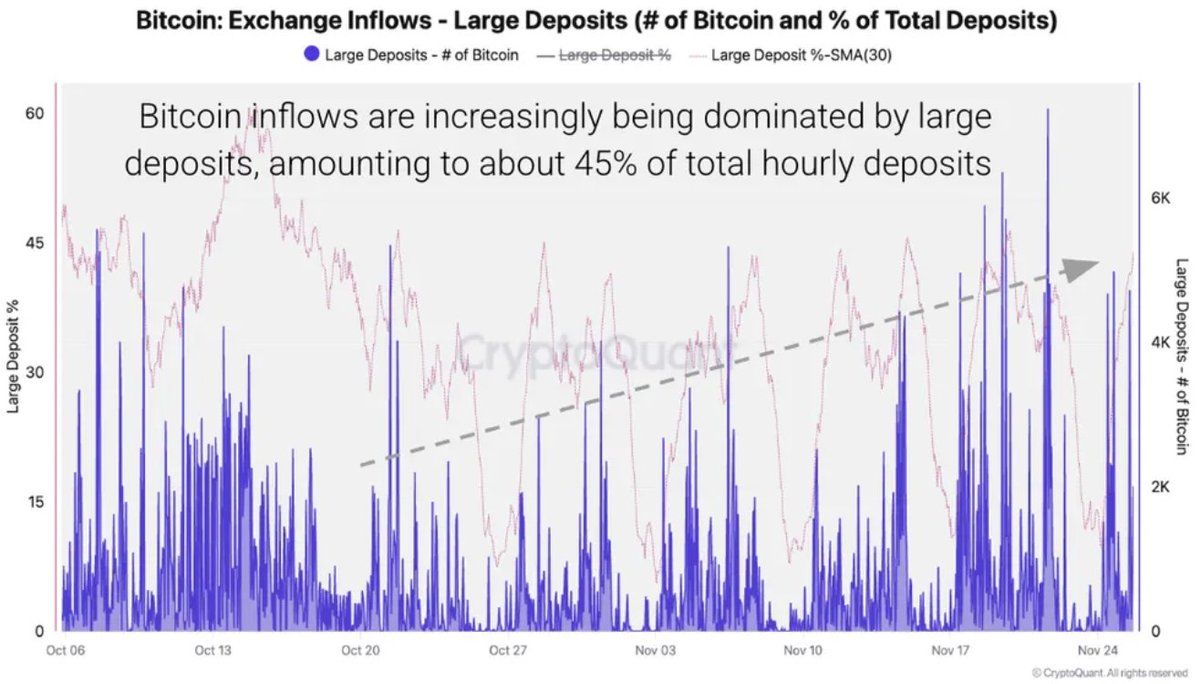

Bitcoin Breaks $90K but Exchange Data Shows Rising Selling Pressure

Global Exchanges Urge SEC to Curb Broad Crypto Exemptions, Warn on Tokenized Stock Risks