Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $87.7 million; US Ethereum spot ETFs saw a net outflow of $65.4 million

UAE-based Mashreq Capital has included bitcoin ETFs in its new multi-asset fund.

Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETFs See Net Outflow of $87.7 Million

Last week, US Bitcoin spot ETFs experienced net outflows for two consecutive days, with a total net outflow of $87.7 million, bringing the total net asset value to $117.11 billions.

Last week, five ETFs were in a net outflow state, with the main outflows coming from ARKB, IBIT, and GBTC, which saw outflows of $77.8 million, $49.1 million, and $29.7 million, respectively.

Data source: Farside Investors

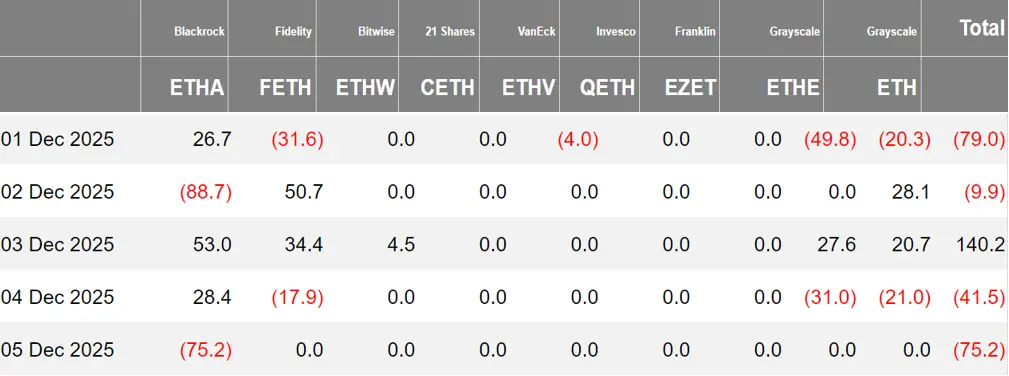

US Ethereum Spot ETFs See Net Outflow of $65.4 Million

Last week, US Ethereum spot ETFs saw net outflows for four days, with a total net outflow of $65.4 million,and a total net asset value of $18.94 billions.

The main outflow last week came from BlackRock ETHA, with a net outflow of $55.8 million. Four Ethereum spot ETFs were in a net outflow state.

Data source: Farside Investors

Hong Kong Bitcoin Spot ETFs See Net Inflow of 72.56 Bitcoins

Last week, Hong Kong Bitcoin spot ETFs saw a net inflow of 72.56 Bitcoins, with a net asset value of $350 million. Among them, the holdings of the issuer Harvest Bitcoin dropped to 291.47 Bitcoins, while ChinaAMC increased to 2,370 Bitcoins.

Hong Kong Ethereum spot ETFs saw no capital inflow, with a net asset value of $102 million.

Data source: SoSoValue

Performance of Crypto Spot ETF Options

As of December 5, the notional total trading volume of US Bitcoin spot ETF options was $1.75 billion, with a notional total long-short ratio of 1.07.

As of December 4, the notional total open interest of US Bitcoin spot ETF options reached $32.65 billion, with a notional total long-short ratio of 1.83.

In the short term, trading activity for Bitcoin spot ETF options has declined, but overall sentiment remains bullish.

In addition, implied volatility is at 48.89%.

Data source: SoSoValue

Overview of Crypto ETF Developments Last Week

Grayscale Submits SUI ETF Registration Application

According to official documents, Grayscale Investments submitted an S-1 registration statement to the US Securities and Exchange Commission (SEC) on December 5, 2025, applying to launch the Grayscale Sui Trust (SUI) ETF product.

Sui: First 2x Leveraged SUI ETF Approved by US SEC, Listed on Nasdaq

According to official sources, the US Securities and Exchange Commission (SEC) has approved the first 2x leveraged SUI ETF (TXXS), issued by 21Shares, which is now listed on Nasdaq.

UAE's Mashreq Capital Includes Bitcoin ETF in Its New Multi-Asset Fund

According to Cryptopolitan, UAE asset management company Mashreq Capital, headquartered in the Dubai International Financial Centre (DIFC), announced the launch of the multi-asset investment mutual fund BITMAC. The fund covers multiple asset classes including equities, fixed income, gold, and Bitcoin via ETFs, with 90% invested in global equities and global fixed income, 5% in gold, and 5% in Bitcoin.

The fund is aimed at retail investors, with a minimum investment of $100. It provides retail investors with an institutional-grade path to allocate both traditional and digital asset classes within a single retail fund solution.

21Shares Launches 2x Leveraged SUI ETF TXXS on Nasdaq

According to Sui Foundation, 21Shares launched the first leveraged SUI ETF (TXXS) on Nasdaq after receiving approval from the US Securities and Exchange Commission (SEC). 21Shares will provide investors with a regulated listed instrument designed to offer double direct exposure to SUI performance without directly holding the underlying asset.

Franklin Templeton Announces Solana ETF Details, Initial Holdings of 17,000 SOL, Staking Rewards to Be Included as Income

Franklin Templeton officially released details of its Solana spot ETF, with an initial SOL holding of 17,000 (custodied by Coinbase Custody), valued at approximately $2.4 million. In addition, the ETF currently has 100,000 shares outstanding and a trading fee rate of 0.19%. Franklin Templeton stated that the fund will stake its SOL holdings to earn rewards, and the related SOL staking rewards will be included as income.

Gemini to Provide Custody Services for VanEck Solana ETF

Crypto exchange Gemini will provide custody services for the VanEck Solana Exchange Traded Fund (VSOL). VSOL is the third SOL spot ETF in the US and one of the first spot ETFs to offer staking rewards. Gemini has previously provided custody services for the VanEck Bitcoin Trust (HODL) and VanEck Ethereum ETF (ETHV).

The company stated it has completed SOC 1 Type 2 and SOC 2 Type 2 audits, certified by Deloitte, with assets fully backed 1:1 and segregated from other user assets.

US SEC Issues Warning Letters to Nine ETF Providers, Demanding Response to Risks of "Proposed High Leverage"

According to Reuters, the US Securities and Exchange Commission (SEC) sent warning letters to nine ETF providers, including Direxion, ProShares, and GraniteShares, requiring them to fully address risk issues regarding ETFs proposing more than 2x leveraged exposure (including some crypto products). "We sent letters expressing concerns about registered exchange-traded funds designed to provide more than 2x leveraged exposure to underlying indices or securities."

US SEC Tightens Regulation of High-Leverage ETFs, Halts Launch of 3-5x Leveraged Products

According to Solid Intel, following recent market volatility, the US Securities and Exchange Commission (SEC) has tightened regulation of high-leverage ETFs, issuing warning letters to relevant issuers and effectively halting the launch of new 3x to 5x leveraged products.

VanEck Announces Extension of Zero-Fee Policy for Its Bitcoin ETF Until July 31, 2026

VanEck announced on X that the company will extend the zero-fee policy for the VanEck Bitcoin ETF (ticker: HODL) until July 31, 2026.

Grayscale Chainlink Trust ETF Listed as a New Spot ETP on NYSE Arca

Grayscale announced that the Grayscale Chainlink Trust ETF (ticker: GLNK) has begun trading as a spot ETP on the New York Stock Exchange Arca.

GLNK is an exchange-traded product that is not registered under the Investment Company Act of 1940 and therefore is not subject to the same regulation and protections as ETFs and mutual funds registered under the 40 Act.

Wall Street Investment Bank Cantor Fitzgerald Discloses Holding $1.28 Million in Solana ETF

According to market sources, Wall Street investment bank Cantor Fitzgerald disclosed that it holds $1.28 million worth of Volatility Shares Solana ETF shares, marking the first time the company has been revealed to hold a regulated Solana product.

This document, submitted to the US Securities and Exchange Commission (SEC) in mid-November, listed 58,000 shares of Volatility Shares Solana ETF (Nasdaq ticker: SOLZ). At the time of submission, the holding value of the Volatility Shares Solana ETF was $1,282,960.

Franklin Crypto Index ETF Adds Six New Tokens Including ADA

Franklin Templeton Digital Assets tweeted that the Franklin Crypto Index ETF has added ADA, LINK, DOGE, SOL, XLM, and XRP tokens.

Previously, the Franklin Crypto Index ETF only held ETH and BTC simultaneously.

Vanguard Group to Allow Trading of Crypto ETFs on Its Platform

According to Bloomberg, Vanguard Group, the world's second-largest asset management company, announced that it will allow ETFs and mutual funds primarily holding specific cryptocurrencies such as Bitcoin, Ethereum, XRP, and Solana to be traded on its platform.

Goldman Sachs Acquires Innovator for $2 Billion, Adding a Bitcoin-Linked ETF to Its Product Line

Goldman Sachs has agreed to acquire Innovator Capital Management for approximately $2 billion, bringing the issuer of "defined outcome" exchange-traded funds (ETFs) into its asset management portfolio. Its products include a Bitcoin structured fund. The transaction is expected to be completed in the second quarter of 2026, at which time Goldman Sachs' asset management division will add about $28 billion in regulated assets.

Opinions and Analysis on Crypto ETFs

VanEck: Digital Asset AUM Exceeds $5.2 Billion, Bitcoin ETF Fee Waiver Extended to End of July Next Year

US asset management company VanEck disclosed that its total assets under management have reached $171.7 billion, with digital asset AUM exceeding $5.2 billion, covering its full range of digital asset solutions. In addition, VanEck announced that the fee waiver period for its Bitcoin ETF has been extended from the previous date to July 31, 2026.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Behind the Moore Threads Wealth Boom: Co-founder Li Feng's "Crypto" History

Before Moore Threads was listed on the STAR Market, Li Feng had another secret history in the crypto space.

Dr. Xinxin Fan, Head of Research and Development at IoTeX, wins ICBC Best Paper Award for his quantum-safe paper, which will be first applied to the IoTeX blockchain network.

IoTeX Head of Research Dr. Xinxin Fan co-authored a paper titled "Enabling a Smooth and Secure Post-Quantum Transition for Ethereum," which was awarded Best Paper at the 2024 International Conference on Blockchain (ICBC 2024).

Morning News | Strategy has accumulated over 200,000 bitcoins so far this year; US SEC Chairman says US financial markets may move on-chain within two years

A summary of major market events on December 7th.

Weekly News Preview | Federal Reserve Announces Interest Rate Decision; Stable Mainnet Launch

This week's top news highlights from December 8 to December 14.