Morning News | Strategy has accumulated over 200,000 bitcoins so far this year; US SEC Chairman says US financial markets may move on-chain within two years

A summary of major market events on December 7th.

Compiled by: ChainCatcher

Important News:

- CZ: The requirement for hardware wallets is that the private key must never leave the device under any circumstances

- Moore Threads co-founder Li Feng reportedly involved in ICO projects and a dispute over 1,500 bitcoins owed

- Michael Saylor: Strategy has accumulated over 200,000 bitcoins so far this year

- Solana Foundation President calls on Kamino and Jupiter to stop infighting and focus on expanding market share

- US SEC Chairman: The entire US financial market may move on-chain within two years

- Jensen Huang: Bitcoin converts surplus energy into a liquid currency

What important events happened in the past 24 hours?

US SEC Chairman: The entire US financial market may move on-chain within two years

ChainCatcher reports, according to Forbes, that Paul Atkins, Chairman of the US Securities and Exchange Commission, stated that the entire US financial market could migrate to blockchain technology supporting bitcoin and cryptocurrencies within the next two years.

Paul Atkins, Chairman of the US Securities and Exchange Commission, said in an interview with Fox Business, "This will not only be a trend for the next 10 years, but could become a reality in just two years. The next step will come with digital assets, market digitization, and tokenization, which will bring huge benefits for transparency and risk management." Tokenization refers to representing stocks and assets with tradable blockchain-based tokens, a concept hailed as a potential revolution in financial markets.

Michael Saylor releases bitcoin Tracker info again, may disclose additional purchases next week

ChainCatcher reports that Strategy founder Michael Saylor has once again released information related to the bitcoin Tracker, writing "₿ack to Orange Dots."

According to previous patterns, Strategy usually discloses additional bitcoin purchases the day after such announcements.

Paradigm co-founder: This is the "Netscape/iPhone moment" for crypto

ChainCatcher reports that Matt Huang, co-founder of crypto investment firm Paradigm, posted on social media, "I don't know who needs to hear this, but this is crypto's 'Netscape moment' or 'iPhone moment' right now."

"Its scale of operation is unprecedented, bigger than we ever imagined, and both at the institutional level and among cypherpunks, development is accelerating."

For reference, the Netscape moment (1995): The release of the Netscape browser brought the internet into the mainstream. That moment marked the beginning of the internet's transition from a niche technology to mass adoption; the iPhone moment (2007): The launch of the iPhone led to explosive growth in mobile internet, fundamentally changing how people use technology, pay, socialize, and consume.

Strategy CEO: The company's USD reserves can support at least 21 months without selling bitcoin

ChainCatcher reports that Strategy CEO Phong Le recently explained in an interview with CNBC's "Power Lunch" the correlation between $MSTR stock and bitcoin price, how the company's USD reserves address market FUD (fear, uncertainty, and doubt), key drivers of market volatility, and why bitcoin's long-term outlook remains strong.

Le clarified that the company's current USD reserves can support at least 21 months without selling bitcoin, and received positive feedback from investors, who recognized his transparent communication and long-term strategic planning.

US SEC Chairman: The entire financial system will shift to bitcoin and cryptocurrencies within a few years

ChainCatcher reports that the Chairman of the US Securities and Exchange Commission stated in an interview that the entire financial system will shift to bitcoin and cryptocurrencies within a few years. This is the future of the world.

Solana Foundation President calls on Kamino and Jupiter to stop infighting and focus on expanding market share

ChainCatcher reports that Solana Foundation President Lily Liu posted on social media, "Hey, Kamino and Jupiter. Overall, our lending market size is about $5 billion. Ethereum's is about 10 times that. The collateral market in traditional finance is many times larger than both."

"We can mock each other (like 'one-click loan position switching', making fun of each other's offhand comments, etc.), or we can choose to focus our energy on capturing more market share from the entire crypto industry and ultimately moving into traditional finance."

It is reported that Jupiter COO Kash Dhanda recently responded to community concerns, stating that the team's previous claims on social media that Jupiter Lend vaults had "zero contagion risk" were inaccurate. Jupiter had earlier promoted its lending vaults as having an "isolated risk" structure and claimed that trading pairs would "not cross-infect, thus eliminating any contagion risk," but this content has since been deleted.

Last week, Solana lending platform Kamino, concerned about misleading risk models, blocked Jupiter Lend's migration tool, and its co-founder publicly criticized Jupiter's risk statements.

Moore Threads co-founder Li Feng reportedly involved in ICO projects and a dispute over 1,500 bitcoins owed

ChainCatcher reports, according to Foresight News, that Moore Threads surged nearly 470% on its first day of listing on the STAR Market on December 5, with its market value exceeding 300 billion yuan. However, at the same time, co-founder Li Feng's past controversies in the crypto industry have resurfaced.

The report points out that in 2017, Li Feng participated with Li Xiaolai and others in issuing a token project called "Malegecoin (MGD)." The project raised about 5,000 ETH during the ICO boom, but the white paper exaggerated the team's background and some fund uses were opaque. Under regulatory pressure, the project was later renamed "Alpaca Coin." In addition, in 2018, OKX founder Star publicly accused Li Feng of failing to return 1,500 bitcoins borrowed and said legal proceedings had been initiated in both China and the US.

The loan agreement shown by Star indicated that the two parties first signed an agreement in 2014, renewed it in 2017 due to extension needs, but ultimately defaulted. Due to cross-border enforcement and legal recognition issues of virtual assets, the dispute remains unresolved.

Crypto KOL: There is a time gap between Binance Futures official account tweets and on-chain token launches, possibly involving insider trading

ChainCatcher reports that crypto KOL "Nine Lives" (@CryptoKobe92) revealed that the Binance Futures official X account posted a tweet about "Year of the Yellow Fruit" with an image at 13:30 (UTC+8) today, while the token launch depicted in the image occurred on-chain at 13:29 (UTC+8), suggesting possible insider trading.

Currently, the related tweet appears to have been deleted. Binance Customer Support stated that they are aware of the feedback and are conducting an internal review. Binance maintains a zero-tolerance policy for any listing-related or other corrupt activities. Once the investigation is confirmed, the community will be informed of the progress as soon as possible.

Star responds to debt dispute with Moore Threads co-founder Li Feng: Debt issues will be handled by law

ChainCatcher reports that Star responded on social media to the topic of "Moore Threads co-founder Li Feng borrowing 1,500 BTC from Star and then disappearing without repayment," saying, "People can't always stay in the shadow of negative history. Looking to the future, let's contribute more positive energy. Debt issues should be handled by law. Best wishes to every entrepreneur."

ChainCatcher previously reported that Moore Threads surged nearly 470% on its first day of listing on the STAR Market on December 5, with its market value exceeding 300 billion yuan. However, at the same time, co-founder Li Feng's past controversies in the crypto industry have resurfaced.

Jensen Huang: Bitcoin converts surplus energy into a liquid currency

ChainCatcher reports that NVIDIA CEO Jensen Huang recently stated, "Bitcoin is converting and storing surplus energy into a new form of currency that you can carry with you and transport anywhere."

Michael Saylor: Strategy has accumulated over 200,000 bitcoins so far this year

ChainCatcher reports that Michael Saylor stated that Strategy has accumulated over 200,000 bitcoins so far this year, specifically 203,600. On Monday, Strategy announced that it had purchased 130 bitcoins last week for a total of about $11.7 million, at an average price of about $89,960. As of November 30, 2025, Strategy holds 650,000 bitcoins, with a total value of about $48.38 billion, at an average price of about $74,436.

ChainCatcher reports that CZ responded to Onekey founder Yishi on the X platform, saying that his personal requirement for hardware wallets is that the private key must never leave the device under any circumstances. In addition, CZ also explained why he claims to "not be an expert," stating that experts excel at incremental improvements, telling you what is impossible and all potential problems, but rarely invent anything radically new.

ChainCatcher reports that Jupiter Exchange COO Kash Dhanda recently responded to community concerns, stating that the team's previous claims on social media that Jupiter Lend vaults had "zero contagion risk" were inaccurate. Jupiter had earlier promoted its lending vaults as having an "isolated risk" structure and claimed that trading pairs would "not cross-infect, thus eliminating any contagion risk," but this content has since been deleted.

In a video posted on X, Dhanda confirmed that the vaults are indeed isolated by design, but also admitted that Jupiter Lend involves rehypothecated assets. Last week, Solana lending platform Kamino, concerned about misleading risk models, blocked Jupiter Lend's migration tool, and its co-founder publicly criticized Jupiter's risk statements.

Meme Hot List

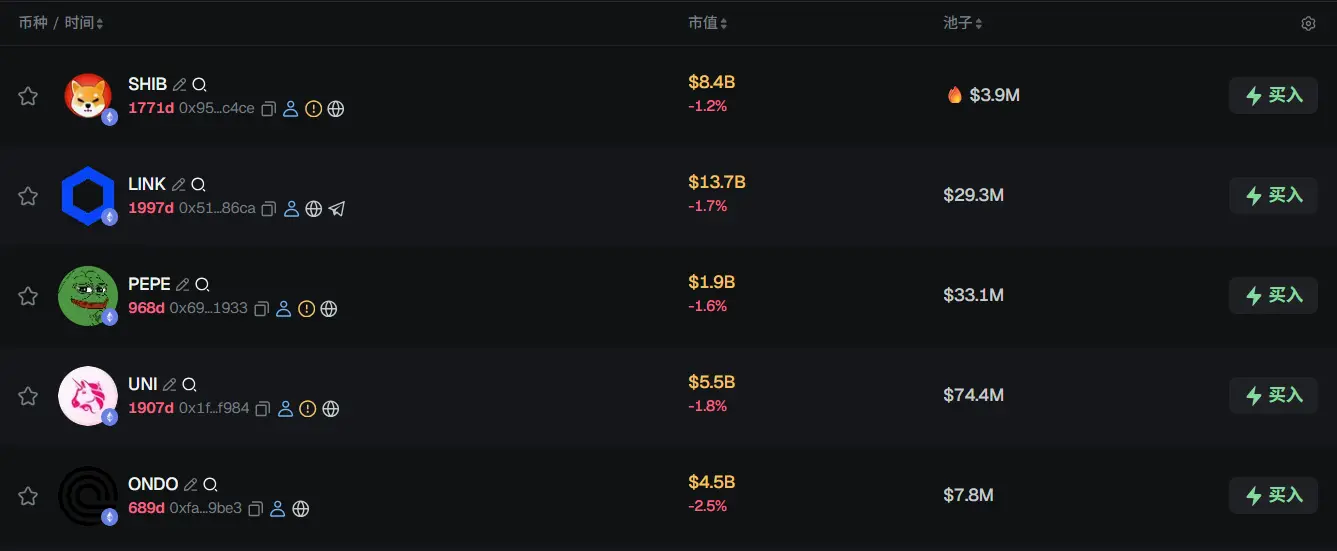

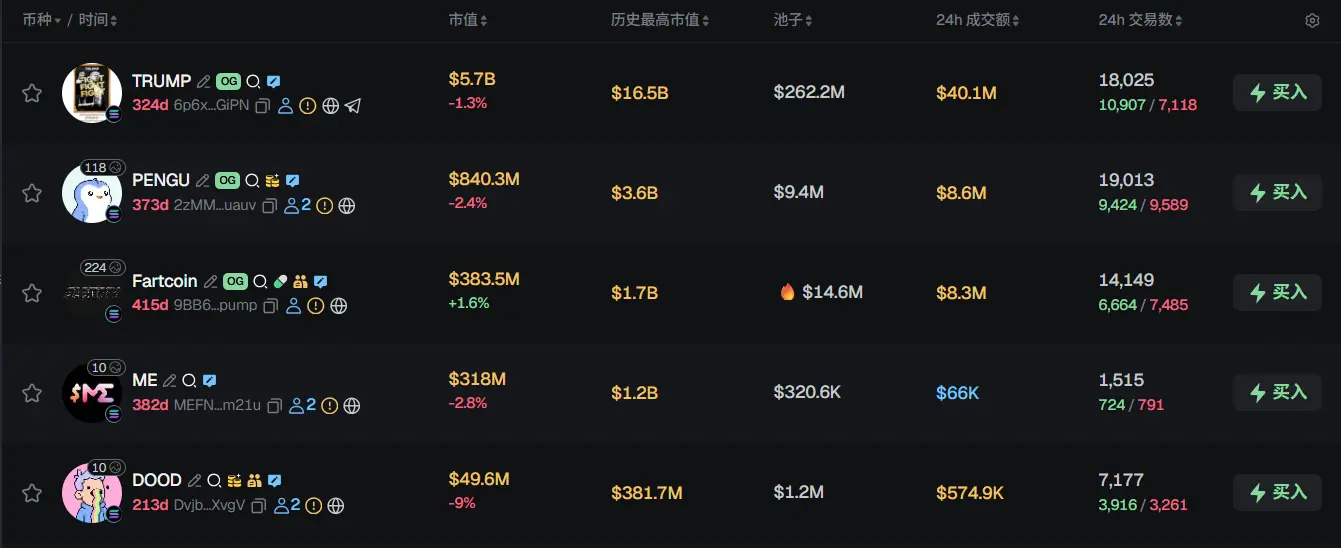

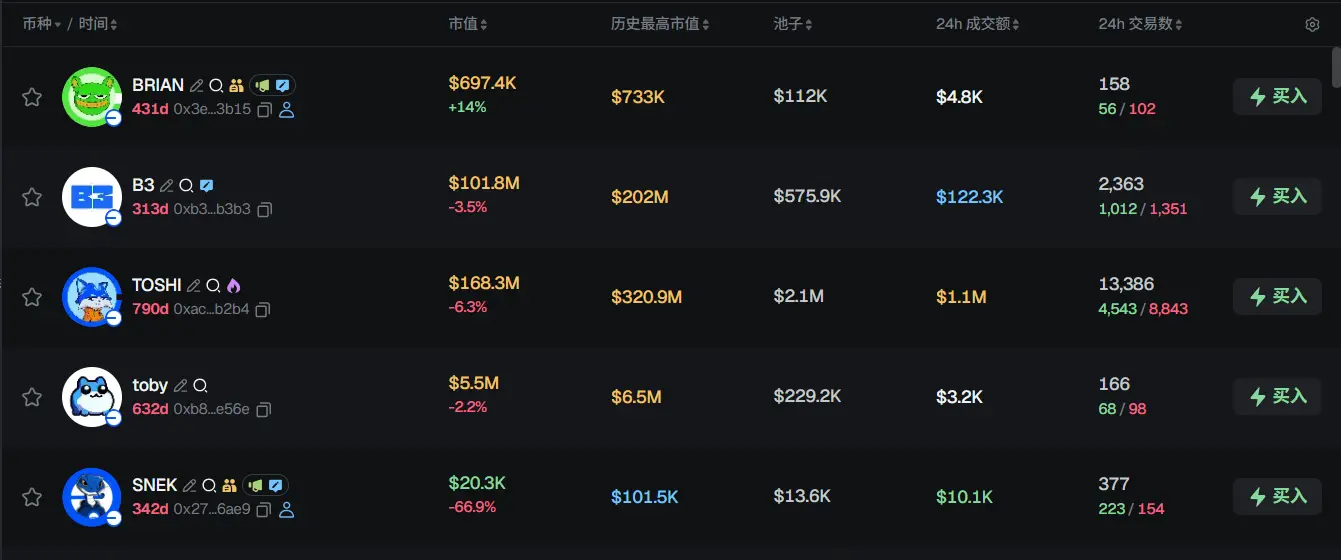

According to data from the Meme token tracking and analysis platform GMGN, as of December 8, 09:00 (UTC+8),

The top five trending ETH tokens in the past 24h are: SHIB, LINK, PEPE, UNI, ONDO

The top five trending Solana tokens in the past 24h are: TRUMP, PENGU, Fartcoin, ME, DOOD

The top five trending Base tokens in the past 24h are: BRIAN, B3, TOSHI, toby, SNEK

What are some great articles worth reading from the past 24 hours?

In-depth reflection: I wasted eight years in the crypto industry

In recent days, an article titled "I Wasted Eight Years in the Crypto Industry" has garnered over a million views and widespread resonance on Twitter, directly addressing the casino nature and nihilistic tendencies of cryptocurrencies. ChainCatcher has translated this article for everyone's discussion.

Cryptocurrency is confusing. On one hand, some promoters claim they want to completely replace the existing financial system with a blockchain-based system. I can easily imagine such a system—where you only need to keep USDC or bitcoin in your bank account and can send a billion dollars to anyone in the world in seconds. This idea is powerful, and I still believe in it to this day.

Bloomberg: Electricity theft exceeds 1.1 billions, rampant bitcoin mining in Malaysia

In Malaysia's hotspots for illegal cryptocurrency mining, crackdowns begin from the air. Drones hover over rows of shops and abandoned houses, searching for abnormal heat sources—a typical sign of illegal mining machines in operation. On the ground, police use sensors to check for abnormal electricity usage. Sometimes, the methods are more primitive: residents report hearing strange bird calls, and when police arrive, they discover that someone is playing nature sounds to cover up the roar of machines behind closed doors.

These tools together form a mobile surveillance network, working to eradicate illegal bitcoin mining.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dr. Xinxin Fan, Head of Research and Development at IoTeX, wins ICBC Best Paper Award for his quantum-safe paper, which will be first applied to the IoTeX blockchain network.

IoTeX Head of Research Dr. Xinxin Fan co-authored a paper titled "Enabling a Smooth and Secure Post-Quantum Transition for Ethereum," which was awarded Best Paper at the 2024 International Conference on Blockchain (ICBC 2024).

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net outflow of $87.7 million; US Ethereum spot ETFs saw a net outflow of $65.4 million

UAE-based Mashreq Capital has included bitcoin ETFs in its new multi-asset fund.

Weekly News Preview | Federal Reserve Announces Interest Rate Decision; Stable Mainnet Launch

This week's top news highlights from December 8 to December 14.

Wang Yongli: Why did China resolutely halt stablecoins?

China is accelerating the development of the digital yuan, and its policy stance to resolutely curb virtual currencies, including stablecoins, has become fully clear. This approach is based on a comprehensive consideration of factors such as China’s global leadership in mobile payments and the digital yuan, the sovereignty and security of the renminbi, and the stability of the monetary and financial system.