News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin's Structural Bottom: A Strategic Entry Point for Long-Term Investors2Ethereum (ETH) Price Prediction for August 31, 2025: Is Now the Time to Buy the Dip?3XRP's AMM Liquidity and RLUSD: A Strategic DeFi Play for Risk-Adjusted Returns

Metaplanet tops 20,000 Bitcoin ahead of key capital-raising vote

Cryptobriefing·2025/09/01 10:45

South Korea's FSC Chairman Nominee: Cryptocurrencies Lack Intrinsic Value

Cointime·2025/09/01 10:35

Litecoin Official X Post Could Prompt XRP Backlash as LTC and XRP Prices Dip

Coinotag·2025/09/01 10:20

Nate Geraci Says XRP ETF Demand May Be Undervalued as SEC Filings and Institutional Interest Grow

Coinotag·2025/09/01 10:20

Ethereum Supply Shift: Whales Accumulating While Retail Sells Could Signal New Bull Cycle

Coinotag·2025/09/01 10:20

Ethereum Near $4,475: Clearing $4,500 or Holding $4,362–$4,200 Could Determine Next Direction

Coinotag·2025/09/01 10:20

Flash

- 11:11Convano increases holdings by 155 BTC, bringing total holdings to 519.93 BTCJinse Finance reported that several Japanese companies are increasing their investments in bitcoin. Among them, Metaplanet added 1,009 bitcoins, bringing its total holdings to 20,000; Convano added 155 bitcoins, with total holdings reaching 519.93. Meanwhile, S-Science (currently holding 30.74 bitcoins) announced a significant increase in its bitcoin investment limit from 500 million yen to 9.6 billion yen (approximately 65.3 million US dollars).

- 10:53Machi Big Brother Huang Licheng adds 800 ETH long positions, with total holdings exceeding $115 millionAccording to ChainCatcher, monitored by HyperInsight, Machi Big Brother has increased his ETH long position by 800 ETH (approximately $2.45 million), bringing the total position size to about $116 million. The current unrealized loss is $1.88 million, and the liquidation price is now $3,142.

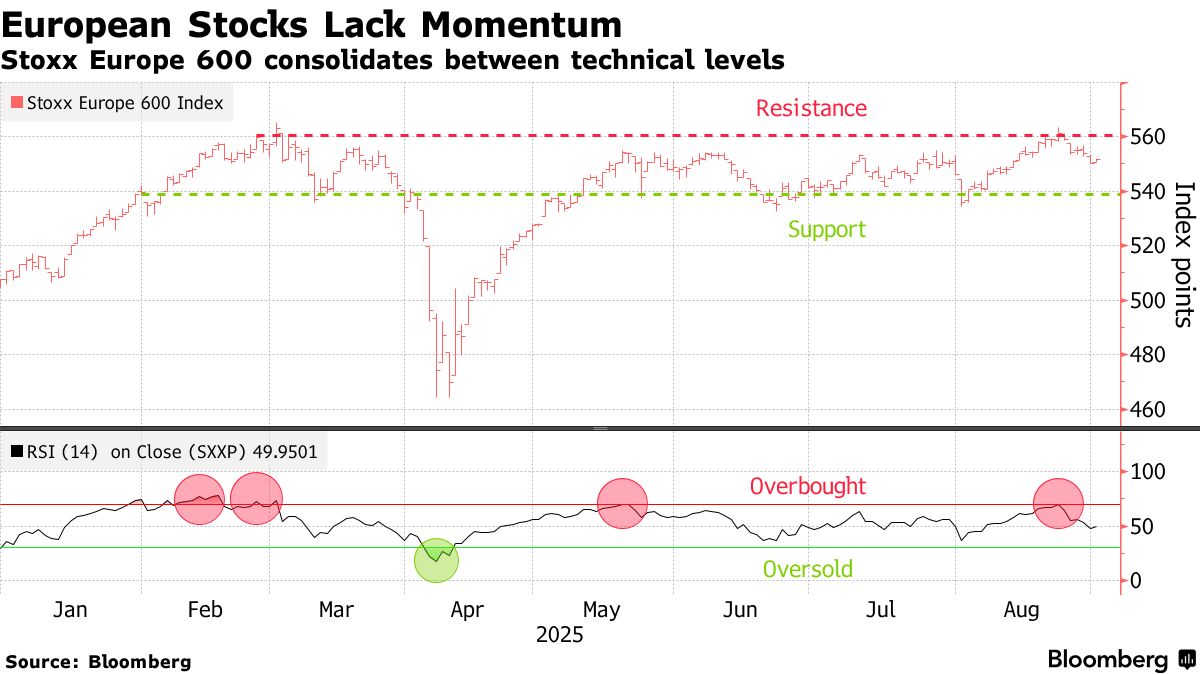

- 10:43The probability of a Fed rate cut in September reaches 99%, with the market focusing on nonfarm payroll data.According to ChainCatcher, citing Jinse Finance, Joshua Mahony, Chief Market Analyst at Rostro, stated that the market is waiting for the August non-farm payroll data to be released on Friday to assess the state of the US economy. The July employment data was weaker than expected, increasing expectations for a Federal Reserve rate cut in September. Data shows that the market expects a 99% probability of a Fed rate cut in September. Before Friday's data release, this week will also see the release of the July JOLTS job openings data and the August ADP employment data.