News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 24)|Ethereum achieves real-time L1 block proof; Solmate surges 40% after $300M financing; Stable’s $825M pre-deposit raises insider concerns2Bitcoin falls below $115,000—is this a delayed reaction to the sale of 80,000 BTC?3Research Report|In-Depth Analysis and Market Cap of aPriori (APR)

Standard Chartered Forecasts Bullish Bitcoin Future Despite Trade Tensions

Theccpress·2025/10/24 15:09

BlackRock Acquires 1,884 Bitcoin for Its ETF

Theccpress·2025/10/24 15:09

Dogecoin price chart projects 25% gains, but first, this must happen

Cointelegraph·2025/10/24 14:36

AI gives retail investors a way out of the diversification trap

Cointelegraph·2025/10/24 14:36

Can Ethereum reclaim $4K? ‘Smart trader’ whale raises ETH long to $131M

Cointelegraph·2025/10/24 14:36

Western inscriptions debut? x402 gold rush floods into PING

PING currently has a market capitalization of over $30 million, with a 24-hour trading volume exceeding $20 million.

ForesightNews 速递·2025/10/24 14:32

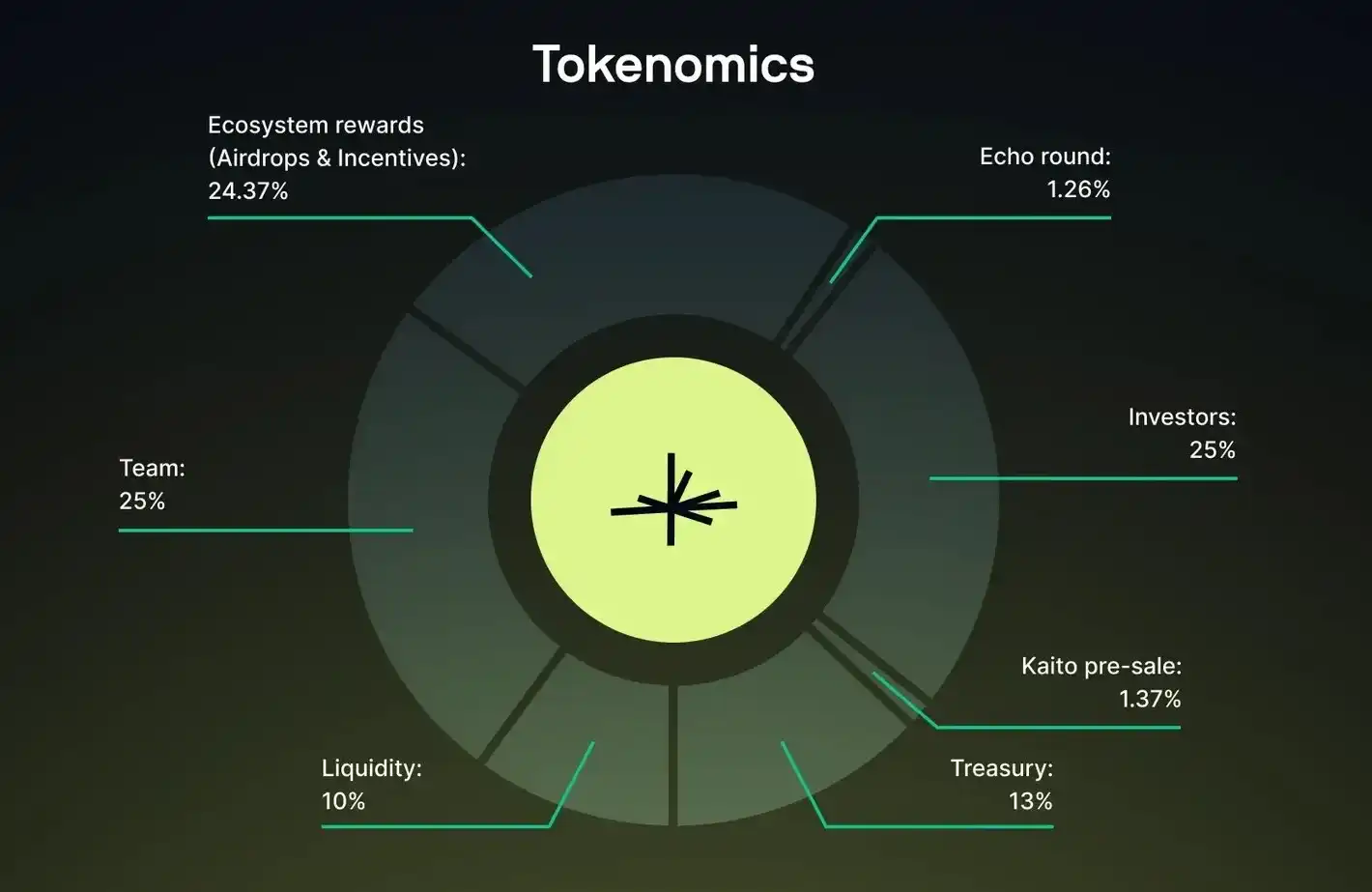

Will MegaETH, with a pre-market value of 5 billions and using an English auction, deliver excess returns?

Polymarket predicts that there is an 89% chance that MEGA will have a trading price exceeding a $2 billions FDV within 24 hours of issuance, and a 50% chance of exceeding a $4 billions FDV.

ForesightNews 速递·2025/10/24 14:31

Ethereum Faces Heavy Selling | Long-Term Trend Still Bullish

TheCryptoUpdates·2025/10/24 13:33

Exclusive Interview with Brevis CEO Michael: zkVM Scaling Is Far More Effective Than L2

The infinite computing layer leads the way for real-world applications.

BlockBeats·2025/10/24 12:44

Limitless surprise TGE: Secret launch to avoid sniping, but unavoidable market doubts

The secretive launch did allow Limitless to avoid technical sniping, but it also made it more difficult for outsiders to trace the early flow of funds.

BlockBeats·2025/10/24 12:43

Flash

- 15:11U.S. payment network Zelle is considering using stablecoin technology for international expansion.Jinse Finance reported that the US payment network Zelle is considering leveraging stablecoin technology for international expansion. Cameron Fowler, CEO of Early Warning Services, stated: "Zelle has changed the way Americans transfer money domestically. Now, we are working to provide consumers with the same fast and reliable service for cross-border remittances through Zelle. Our goal is to bring Zelle's credibility, speed, and convenience to consumers with international remittance needs." Early Warning Services is responsible for operating Zelle. The company said that this initiative, the details of which remain unclear, "marks an important step for Zelle in expanding its global business by utilizing stablecoins." According to a report last month, Zelle has been exploring the issuance of its own stablecoin. According to Early Warning Services, the total amount of transfers completed through Zelle last year was about $1 trillion. Although other payment networks such as PayPal and Wise process a large number of cross-border payments, and many crypto companies are also trying to compete by offering low-cost international remittance services, Zelle has a large customer base that may be interested in the ability to transfer funds to other countries.

- 15:06Statistics Canada: September international merchandise trade data will not be released on November 4Jinse Finance reported that Statistics Canada announced it will not release Canada's international merchandise trade data for September on November 4 due to the U.S. government shutdown.

- 15:00Crypto mining company TeraWulf completes $3.2 billion bond issuanceChainCatcher news, according to Bloomberg, cryptocurrency mining company TeraWulf Inc. has completed a $3.2 billion debt transaction, which is intended for the expansion of its data centers.