News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Shiba Inu Eyes a Massive Rebound as Bulls Eye a 3X Rally

Cryptonewsland·2025/10/19 12:09

Bitcoin Plummets Again, But Here’s Why It Might Be a Bullish Signal

Cryptonewsland·2025/10/19 12:09

HYPE Struggles at $43 — Is a Breakout or Breakdown Coming Next?

Cryptonewsland·2025/10/19 12:09

Bullish XRP Trader Shares Deep Insights Explaining How $8, $20, and $27 Bull Targets Can Be Hit

Cryptonewsland·2025/10/19 12:09

3 Cryptos Ready To Skyrocket — Don’t Miss These Buying Opportunities

Cryptonewsland·2025/10/19 12:09

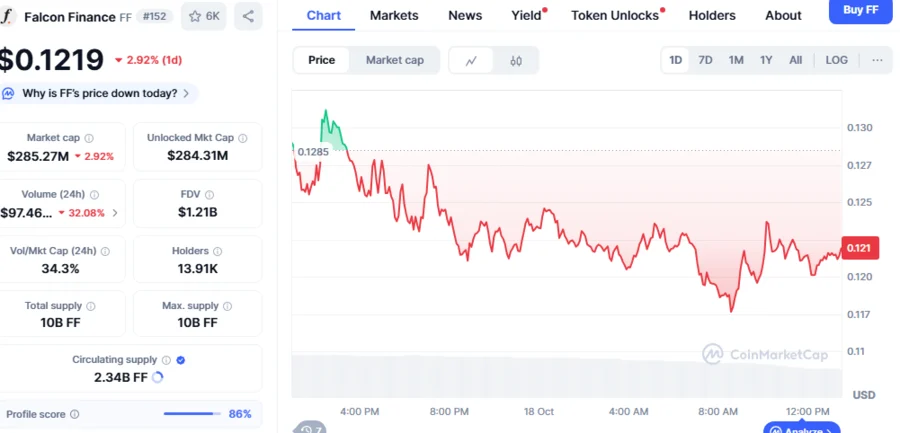

Whales Turn to FF Token Accumulation Amid Falcon Finance’s 37.9% Price Slump

CryptoNewsNet·2025/10/19 11:45

Japan’s FSA weighs allowing banks to hold Bitcoin, other cryptos: Report

CryptoNewsNet·2025/10/19 11:45

XRP, SOL Break Ahead with Bullish Reset in Sentiment as Bitcoin and Ether Stay Stuck in the Gloom

CryptoNewsNet·2025/10/19 11:45

Ripple (XRP) Chief Legal Officer Responds to Criticisms Directed at the Industry

CryptoNewsNet·2025/10/19 11:45

Are Bitcoin Miners Now Abandoning BTC to Work on Artificial Intelligence? Industry Members Respond

CryptoNewsNet·2025/10/19 11:45

Flash

- 13:17Data: The "220 million USD long position whale" has increased holdings to 250 million USDAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that the mysterious whale who went long on BTC and ETH with $220 million has increased their position to $250 million. This latest increase is mainly in BTC, with the ETH position remaining unchanged. With continued efforts, the overall unrealized loss has also narrowed to $3.12 million. BTC 15x long position: holding 1,610.93 BTC ($173 million), entry price $108,043.9; ETH 3x long position: holding 19,894.21 ETH ($77.42 million), entry price $4,037.43.

- 13:01Oly One launches black hole burn mechanism, achieving permanent deflation of OLY tokens through smart contractsAccording to ChainCatcher, Oly One has launched a black hole burn mechanism. This mechanism utilizes smart contracts to automatically burn a portion of OLY tokens during each transaction, achieving permanent deflation. This mechanism aims to provide stability to the DeFi sector by reducing the token supply and combines it with a dynamic bottoming structure to enhance the ecosystem's self-regulation capabilities.

- 12:29STBL announces the launch of its 100 million USST minting plan, with over $2 million already minted in the initial phase.ChainCatcher news, STBL announced on the X platform that its Q4 USST minting plan of 100 million USD has officially launched, and as part of the phased rollout, more than 2 million USD in initial minting has been completed. At the same time, the project team is enhancing the automatic pegging mechanism and integrating with Franklin Templeton's IBENJI to strengthen stability, liquidity, and yield performance.