News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

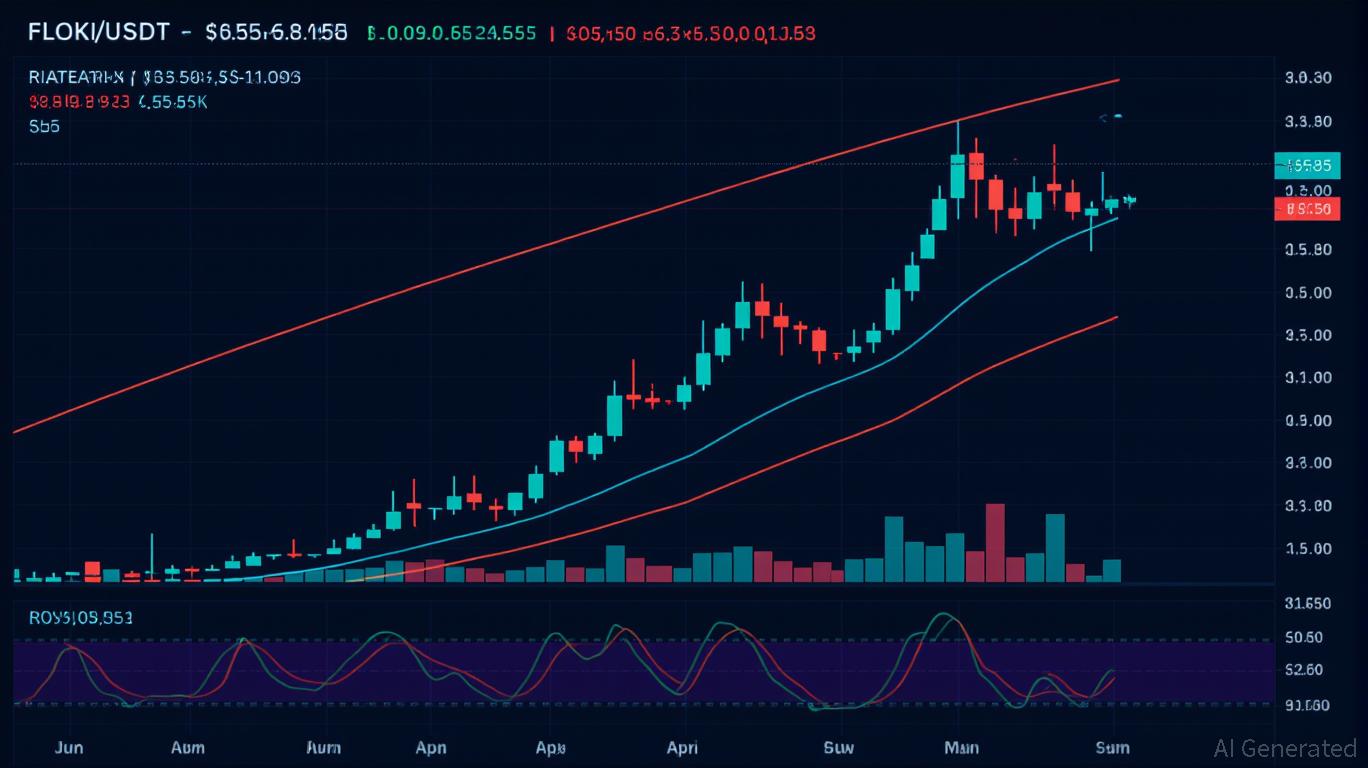

- FLOKI's August 2025 technical setup shows a potential breakout after forming a rounded bottom pattern and key Fibonacci support at $0.00009620. - Mixed moving averages and balanced RSI indicate volatility, with Bollinger Bands signaling momentum but warning of overbought risks near $0.00010553. - Traders face a 12% upside potential if support holds, but bearish pressure could trigger an 8% decline if resistance fails, requiring strict risk management. - Breakout scalping and range trading strategies are

- Stellar Lumens (XLM) forms a 60-70% successful inverse head-and-shoulders pattern, with a potential $1 target if the $0.50 neckline breaks decisively. - Institutional accumulation at $0.39 support and $440M+ in tokenized assets, plus PayPal/Franklin Templeton partnerships, reinforce XLM's macroeconomic tailwinds. - Protocol 23's 5,000 TPS upgrade on Sept 3 and regulatory clarity in major markets create a virtuous cycle of demand, positioning XLM as a high-probability breakout candidate. - Strategic entry

- Over 170 public companies now hold Bitcoin as treasury assets, with firms like KindlyMD and Sequans Communications raising billions via equity to accumulate BTC. - Strategic logic includes Bitcoin's inflation resistance and potential to boost shareholder value through Bitcoin-per-share metrics, though equity dilution risks persist. - Corporate Bitcoin buying pressures institutional demand, tightening supply post-2024 halving while creating feedback loops that could destabilize altcoin markets. - Risks in

- Celebrity-backed memecoins like YZY Money and EMAX exhibit extreme volatility, driven by centralized tokenomics and influencer hype, causing retail investor losses. - Platforms like Polymarket aggregate real-time sentiment on celebrity events (e.g., Taylor Swift pregnancy odds), correlating with consumer behavior and merchandise sales trends. - Sentiment-driven trading strategies leverage prediction market data to forecast cultural trends, linking celebrity endorsements to stock movements and event-drive

- 02:44Data: 18,600 SOL withdrawn from a certain exchange, valued at approximately $2.3868 millionAccording to ChainCatcher, Arkham data shows that at 10:39 (UTC+8), 18,600 SOL (worth approximately $2.3868 million) were transferred from one exchange to another.

- 02:41The total net inflow for the US Solana spot ETF was $10.58 million yesterday.Jinse Finance reported, according to SoSoValue data, that yesterday (Eastern Time, November 21), the total net inflow of Solana spot ETFs was $10.58 million. The SOL spot ETF with the highest single-day net inflow yesterday was the 21Shares SOL ETF TSOL, with a single-day net inflow of $5.97 million. Currently, TSOL's historical total net inflow has reached $7.17 million. Next is the Fidelity SOL ETF FSOL, with a single-day net inflow of $2.97 million. Currently, FSOL's historical total net inflow has reached $12.81 million. As of press time, the total net asset value of Solana spot ETFs is $719 million, with a Solana net asset ratio of 1.01%, and the historical cumulative net inflow has reached $510 million.

- 02:35Moonrock Capital founder: An exchange's acquisition of VECTOR suspected of insider trading, $TNSR surged 8x in two days before plunging 40%ChainCatcher news, Moonrock Capital founder Simon Dedic posted on X, saying, "The acquisition of VECTOR by a certain exchange was a brilliant internal pump. $TNSR surged 8 times during the two days of the market crash, only to plummet 40% after the announcement. Secondly, the actual developer behind Vector, Tensor Foundation, still appears to be independent of this acquisition, including the token itself. Although there is no official announcement yet, it is basically certain that Tensor will cash out a large undisclosed amount, while $TNSR holders, as always, get nothing. This is a case of severe misalignment between equity and token value." Simon Dedic finally called for tokens to be equivalent to on-chain equity.