News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Circle and Finastra join forces to integrate USDC into Global PAYplus, modernizing $5 trillion in daily cross-border flows, cutting costs, and positioning stablecoins as institutional-grade tools amid regulatory scrutiny and global adoption.

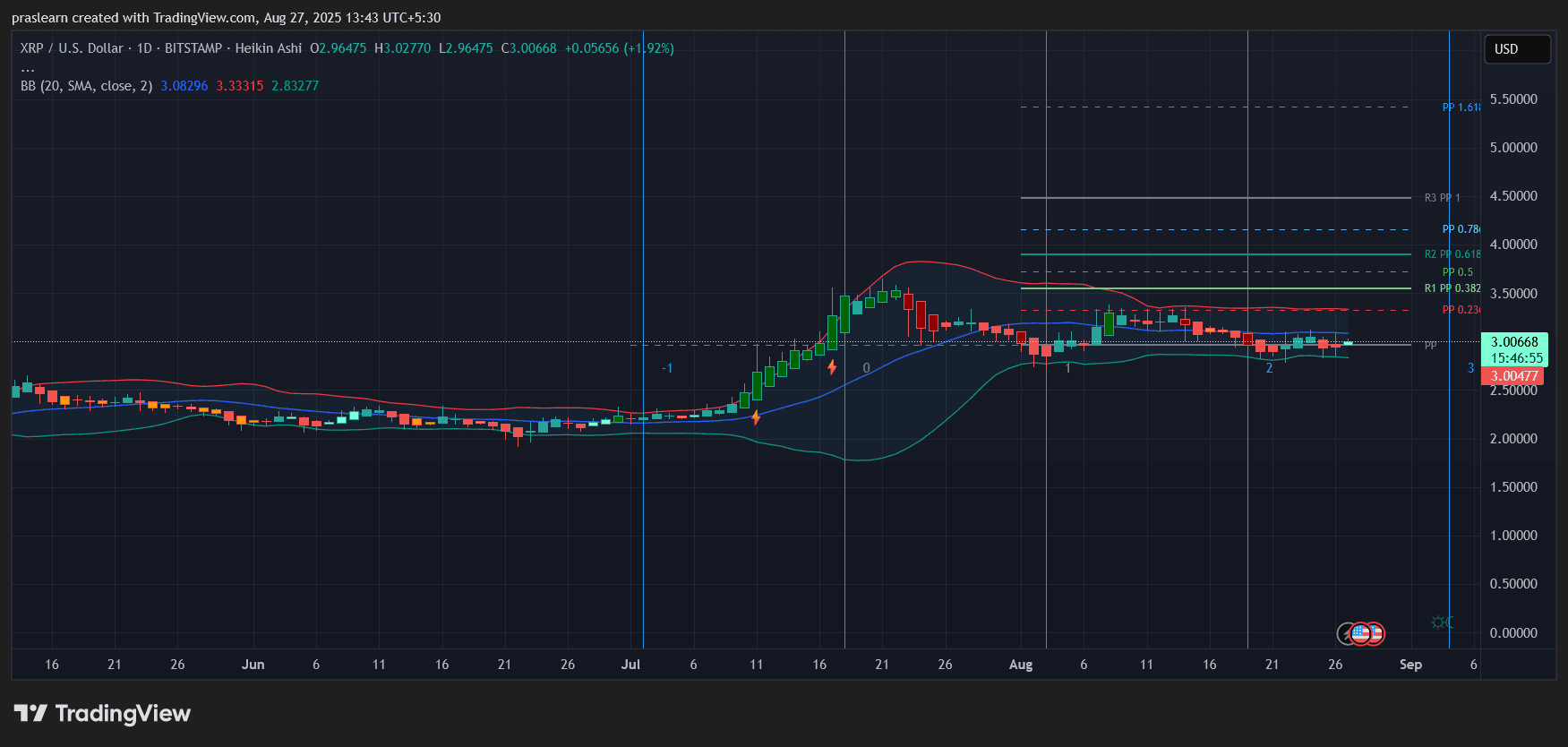

- BlockDAG's $383M 2025 presale and 2,660% ROI highlight infrastructure-driven growth via 2.5M users, 19k ASIC miners, and 300+ dApps. - XRP relies on uncertain ETF approvals ($2.96 price) while HBAR ($0.19) gains from enterprise partnerships but faces governance centralization risks. - Analysts prioritize projects with audited scalability (BlockDAG's DAG-PoW) over speculative bets, emphasizing operational metrics over regulatory outcomes.

- Political-aligned cryptocurrencies like TRUMP Token and World Liberty Financial (WLFI) surged in 2025, blending ideology with speculative growth and institutional backing. - WLFI's $550M token sales and USD1 integration highlight hybrid models merging political influence with regulatory credibility, though 60% family control raises governance concerns. - Risks include regulatory gray areas (SEC's 2025 meme coin reclassification) and reputational volatility, as political fortunes or policy shifts could er

In August 2025, two heavyweight figures from the Ethereum ecosystem—BitMine CEO Tom Lee and ConsenSys CEO Joseph Lubin—publicly expressed interest in the memecoin project Book of Ethereum (BOOE), sparking widespread market discussion. BOOE builds its community economy through a religious narrative, launching related tokens such as HOPE and PROPHET to form a "Trinity of Faith" system. An anonymous whale, fbb4, has promoted BOOE and other memecoins through a long-term holding strategy, but this approach, which relies heavily on market sentiment, carries risks of regulation and bubbles. While institutional endorsements have increased attention, investors are advised to rationally assess the project’s value and associated risks. Summary generated by Mars AI. The accuracy and completeness of this content are still being iteratively improved by the Mars AI model.

- 04:23Aave founder: ETHLend will be relaunched in 2026ChainCatcher news, Aave founder and CEO Stani posted on X, stating: "Bitcoin collateral is real Bitcoin, not wrapped. I guarantee that ETHLend will be relaunched in 2026." It is reported that ETHLend is an independent lending application and the predecessor of Aave. After rebranding from ETHLend in 2018, Aave evolved into a decentralized peer-to-peer lending marketplace.

- 04:06The Federal Reserve's internal consensus mechanism is facing collapse, and the outlook for rate cuts remains uncertain.According to Golden Ten Data, “Fed mouthpiece” Nick Timiraos wrote that Trump is expected to appoint a new Federal Reserve Chair in May next year, after which interest rates are expected to drop sharply. However, internal opposition within the Federal Reserve to a rate cut in December is growing, and Powell is facing the most severe internal resistance of his nearly eight-year tenure. Evercore ISI economist Krishna Guha stated that the decision-making process is breaking down, and next year may see a seriously divided committee, with the December meeting potentially seeing three or even more dissenting votes.

- 03:34mF International to raise $500 million through private placement to establish a Bitcoin Cash treasuryChainCatcher news, Nasdaq-listed company mF International announced a private placement of 50 million Class A common shares and prepaid warrants to qualified institutional investors at $10 per share, raising $500 millions. The funds raised will be used for general corporate operations, and the company will also purchase Bitcoin Cash and establish a related digital asset treasury. This financing transaction is expected to be completed on December 1.