News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Dogecoin's decentralized governance relies on community consensus without formal voting mechanisms, creating inclusive but slow decision-making. - Social media sentiment and influencer actions drive extreme price volatility, exemplified by 300% surges from Elon Musk's tweets and 50% corrections during waning enthusiasm. - 2025 ZKP proposal and $200M whale accumulation signal potential transition from meme coin to utility-driven asset, with institutional adoption growing through treasury initiatives. - Te

- MBOX surged 83.47% in 24 hours on Aug 28, 2025, but remains down 6832.72% annually amid volatile short-term swings. - A technical development triggered sudden buying activity, though weekly declines contrast with the month's 1504.76% rise. - Divergent moving averages and overbought RSI signal heightened volatility, with traders monitoring key support levels for trend confirmation. - A backtesting strategy using MA crossovers and RSI thresholds aims to capture momentum while mitigating overbought correcti

- Q3 2025 altcoin market shows optimism with institutional support and on-chain signals, highlighting Maxi Doge (MAXI) and HYPER as undervalued projects with disruptive potential. - Maxi Doge, an Ethereum-based meme coin with 1,000x leverage trading and 383% APY, raised $1.63M in presale, projecting 12.9x price growth by Q4 2025. - HYPER, a Bitcoin Layer 2 solution using ZK-rollups and SVM, aims to boost scalability and enable a $223B Bitcoin-native DeFi ecosystem, with $12.3M raised and 100x gain projecti

- KindlyMD raised $5B via ATM offering to buy up to 1M BTC, joining corporate giants like MicroStrategy and Tesla as major Bitcoin holders. - The strategy frames Bitcoin as an inflation hedge and treasury diversifier, citing historical outperformance over gold, stocks, and bonds. - Critics highlight risks: extreme price volatility, equity dilution, and regulatory uncertainties around crypto custody and taxation. - The move reflects broader institutional adoption, with top 100 public companies holding ~1M B

- USDC's partnerships with Mastercard and Finastra are reshaping global cross-border payments through blockchain-based stablecoin settlements. - Mastercard enables EEMEA merchants to settle in USDC/EURC, reducing costs and settlement times in underbanked regions while expanding digital inclusion. - Finastra's GPP platform integrates USDC for banks, combining stablecoin efficiency with traditional workflows to mitigate FX risks across 50+ countries. - USDC's $65.2B circulation growth (90% YoY) reflects regu

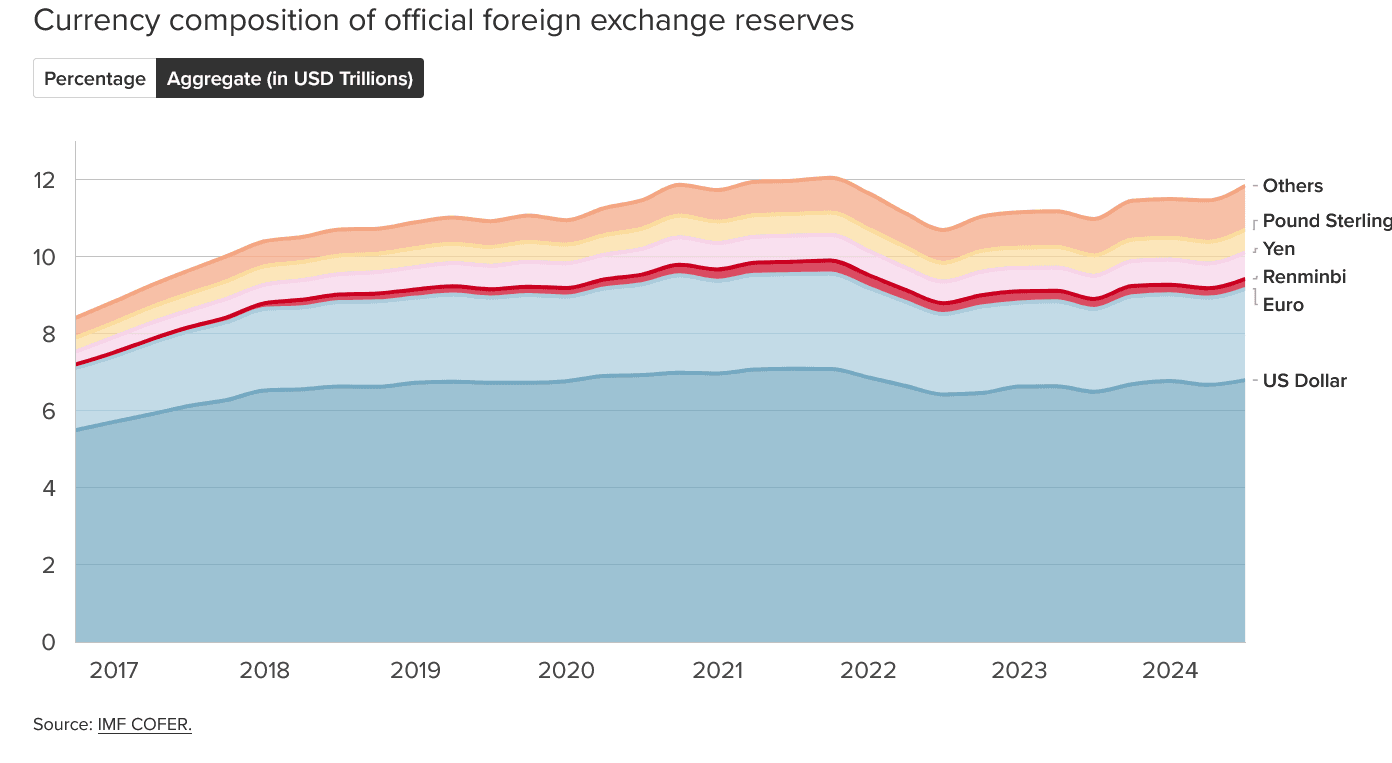

- 2025 institutional Bitcoin adoption reached a pivotal inflection point driven by regulatory clarity, infrastructure innovation, and macroeconomic factors. - U.S. CLARITY/GENIUS Acts and SEC in-kind redemption approvals created legal frameworks enabling $86.79B in Bitcoin ETF assets under management. - Secure custody solutions and hybrid settlement systems (e.g., SPACs) enabled institutions like Harvard to triple Bitcoin exposure to 8% of portfolios. - Macroeconomic tailwinds positioned Bitcoin as inflati