News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- The iShares Silver Trust (SLV) reflects investor psychology via the reflection effect, where risk preferences shift between gains and losses during market cycles. - Historical data (2008-2025) shows silver's mixed performance as a safe-haven asset, with 2008 (-8.7%) outperforming 2020 (-9%) due to diverging industrial vs. speculative demand. - SLV's volatility amplifies behavioral biases: panic selling during downturns (e.g., 11.6% drop in 2025) contrasts with speculative buying, creating liquidity-drive

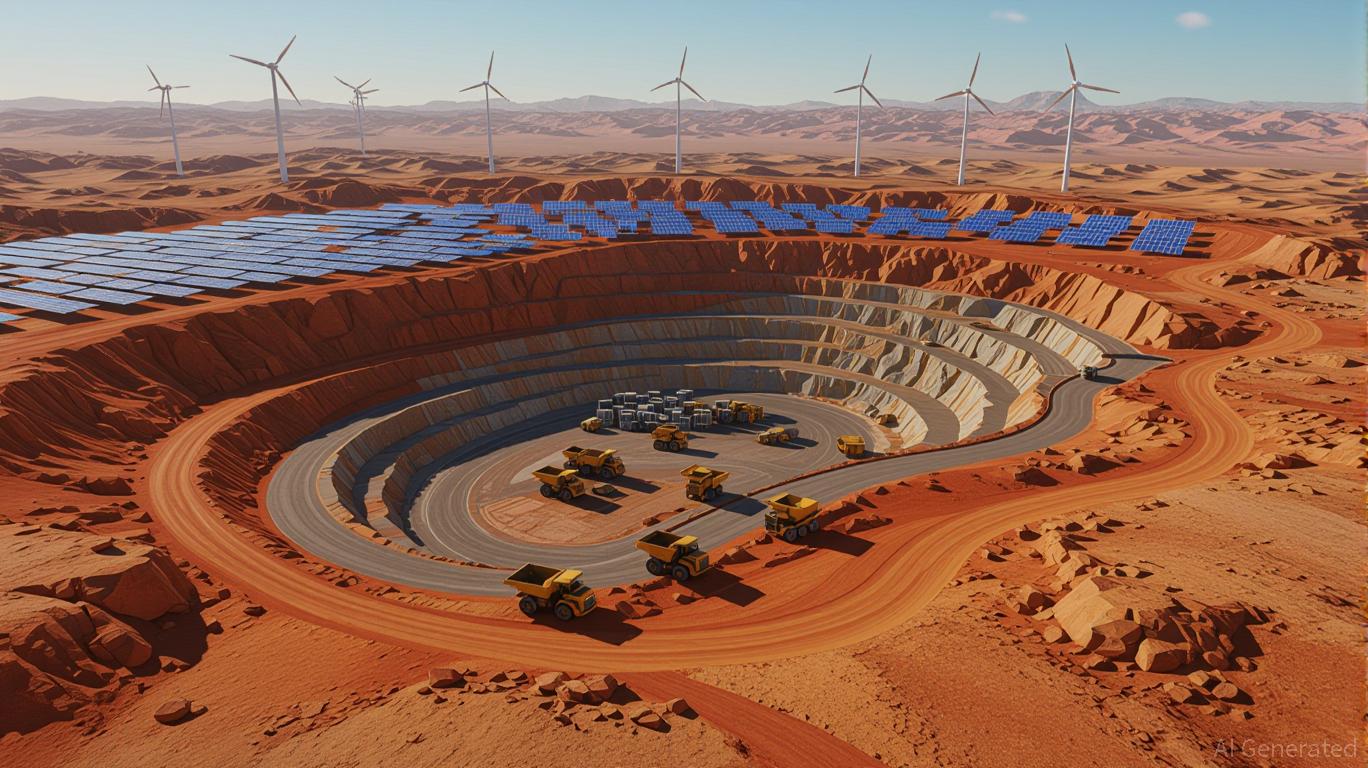

- Global copper markets face supply shocks from mine output drops (7% decline) and geopolitical tensions, while green energy transition drives structural demand growth. - EVs and renewables now account for 40% of demand, with clean energy use projected to triple by 2040, fueled by infrastructure policies in major economies. - Institutional investors adopt core-satellite strategies, allocating 50-60% to majors like BHP while targeting high-growth projects and using ETFs/derivatives for hedging. - Copper's u

- South Africa's shrinking platinum supply, driven by mine closures and strikes, creates a 2025 deficit of 966,000 ounces. - Hydrogen fuel cell adoption is boosting platinum demand, projected to grow from 40,000 to 900,000 ounces by 2030. - Platinum's dual role as an inflation hedge and energy transition enabler positions it as a strategic long-term investment. - Risks include South Africa's operational challenges and emerging catalyst alternatives, though platinum remains unmatched in efficiency.

- In 2025, GLD reflected behavioral economics principles as geopolitical tensions and macroeconomic volatility drove gold prices to $3,500/oz, fueled by U.S.-China trade disputes and Russia-Ukraine conflicts. - The reflection effect shaped investor behavior: risk-averse profit-taking during gains vs. risk-seeking doubling-down during losses, amplified by 397 tonnes of GLD inflows and central bank gold purchases (710 tonnes/qtr). - UBS projected 25.7% gold rebound by late 2025, emphasizing GLD's role as a s

- XRP's 2025 price dynamics reflect legal framework impacts, with civil law jurisdictions (France/Quebec) enabling 22% lower volatility and institutional adoption via MiCA/ARLPE regulations. - Behavioral biases like retail panic selling at $3.0890 and whale accumulation of 340M XRP (93% in profit) highlight divergent retail-institutional dynamics shaping price swings. - SEC's 2025 commodity reclassification and 11 spot ETF filings ($4.3-8.4B potential inflow) created self-reinforcing cycles of utility-driv

Japan’s FSA plans to regulate crypto under securities law, sparking debate over investor protection. Experts caution that extending this framework to failing IEOs could pose risks for retail investors.

Will the overlooked DeFi strong contender Fluid be listed on major exchanges soon?

Only additional income can bring true freedom.

People are speaking out not for self-custody or cypherpunk-style bitcoin discussions, but for political figures and financial engineering.

- 18:26The total market capitalization of stablecoins increased by 1.14% over the past week.Jinse Finance reported, according to DefiLlama data, the total market capitalization of stablecoins has increased by 1.14% over the past week, now standing at $289.23 billions. Among them, USDT's total market capitalization grew by 1.01%, now at $170.535 billions, with a market share of 58.96%.

- 17:41Ethereum's net supply increased by 18,140 in the past 7 daysJinse Finance reported that, according to Ultrasound.money data on September 15, Ethereum's net supply increased by 18,140.29 ETH over the past 7 days, with a total supply increase of approximately 18,582.16 ETH and 441.97 ETH burned through the burning mechanism. The current annual supply growth rate is 0.782%.

- 16:10Data: Galaxy Digital receives over 1.2 million SOL in less than 24 hoursAccording to Jinse Finance, as disclosed by Cointelegraph, Galaxy Digital received over 1.2 million SOL in less than 24 hours.