News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Despite gearing up for its version 23 upgrade, Pi Network’s PI token trades flat at $0.34. Weak inflows and bearish momentum raise the risk of a dip to $0.32 unless demand rebounds.

Bitcoin charts flash bullish reversal signs, hinting at a breakout towards $120K as momentum builds rapidly.The Bullish Crossover ExplainedTrendline Break Could Be the Trigger

Christian Rau says Mastercard views crypto as a payment method, not a revolution—focusing on safety and compliance.Stablecoins: A Step Forward, But Not a Replacement

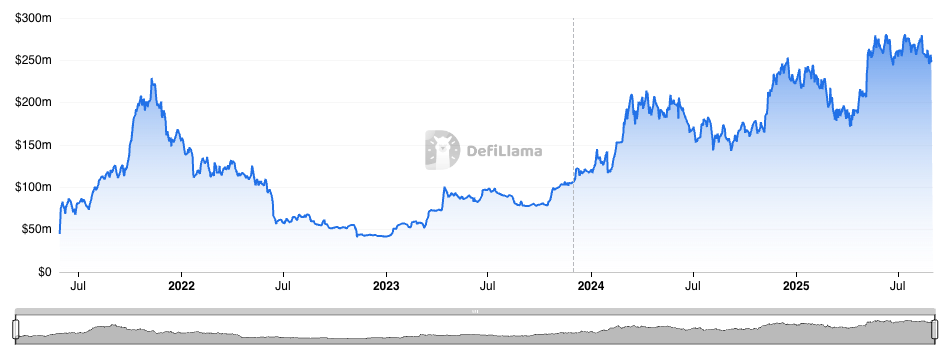

Solana's DEX volume soared to $144B in August, regaining its momentum and matching May’s bullish activity.Why the Spike in Solana DEX Volume?What This Means for Solana and DeFi

The Philippines files SB 1330 to place the national budget on blockchain, boosting transparency and accountability.How Blockchain Will Revolutionize Budget ManagementGlobal Implications and the Future of Public Finance

- 00:24Trump expects the Federal Reserve to cut interest rates by 25 basis points in September.ChainCatcher news, according to Golden Ten Data, ahead of this week's important Federal Reserve meeting, U.S. President Trump expects a "substantial rate cut." The Federal Reserve is expected to take easing measures at this meeting, the first time in nine months. Trump stated: "I think there will be a substantial cut, and the timing for a rate cut is perfect." The market generally expects the Federal Reserve to cut rates by 25 basis points on September 18.

- 00:24Expectations for Fed Rate Cuts Rise, Global Asset Risk Appetite ReboundsChainCatcher news, according to Jinse Finance, a research report from Galaxy Securities pointed out that although the US August CPI data rebounded, it was generally in line with market expectations and inflation remains within a controllable range. Meanwhile, last week’s initial jobless claims unexpectedly rose to 263,000, hitting a nearly four-year high. This combination of signals has further strengthened market expectations that the Federal Reserve will start a rate-cutting cycle within the year. It is expected that the US dollar will weaken in the future, driving capital flows to non-US markets, especially emerging markets and high-yield assets, thereby increasing global risk appetite.

- 00:13Sources: BlackRock executives continue to rise in ranking for Federal Reserve Chair interviewsJinse Finance reported that, according to a U.S. government official, Rick Rieder, a senior executive at BlackRock, has been steadily rising in the list of candidates for the next Federal Reserve Chair. The official, who requested anonymity to discuss private meetings, stated that U.S. Treasury Secretary Bessent held a wide-ranging two-hour interview with Rieder in New York last Friday, during which they discussed topics such as monetary policy, the Federal Reserve's organizational structure, and regulatory policies. The official emphasized that the selection process is still ongoing; so far, Bessent has interviewed 4 out of the 11 publicly known candidates and is expected to add 1 or 2 new candidates to the consideration list. Sources familiar with the Treasury Secretary's thinking revealed that Bessent was impressed by Rieder's extensive experience managing large teams in financial markets and his deep understanding of both micro and macroeconomics. The source stated that if Rieder were to lead the Federal Reserve, he would bring a steady approach and in-depth knowledge of non-bank financial institutions. Earlier last week, Rieder said in a CNBC interview that, based on his interpretation of economic indicators, he believes the Federal Reserve should cut interest rates by 50 basis points—twice the amount widely expected to be announced at this week's FOMC meeting. (Golden Ten Data)