News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The passage of the GENIUS Act in the United States has introduced a regulatory framework for the stablecoin market, sparking enthusiastic responses within the cryptocurrency community, while sounding an alarm for the traditional banking industry.

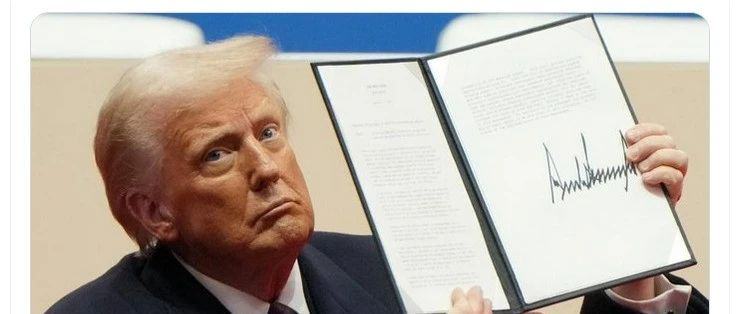

On August 25, 2025, U.S. President Donald Trump announced the immediate dismissal of Federal Reserve Board member Lisa Cook.

Japan Post Bank, the largest deposit institution in Japan, has announced that it will launch a tokenized deposit currency called DCJPY in fiscal year 2026.

A survey commissioned by British insurance company Aviva has revealed the potential influence of cryptocurrencies in the UK's retirement investment sector. More than a quarter of UK adults indicated they are willing to include cryptocurrencies in their retirement portfolios, and 23% are even considering withdrawing existing pension funds to invest in this high-risk asset.

On August 28, 2025, the second Asia Bitcoin Conference grandly opened in Hong Kong, attracting top figures from the global virtual currency industry to gather together.

On August 29, 2025, the Ethereum Foundation announced the suspension of public grant applications for its Ecosystem Support Program (ESP).

Bank of China (Hong Kong) Limited (referred to as "BOCHK") has officially announced that it will apply for a stablecoin issuance license, aiming to become one of the first approved institutions.

- 16:07Data: If Ethereum falls below $4,100, the cumulative long liquidation intensity on major CEXs will reach $1.012 billions.ChainCatcher news, according to Coinglass data, if Ethereum falls below $4,100, the cumulative long liquidation intensity on major CEXs will reach 1.012 billions. Conversely, if Ethereum breaks through $4,300, the cumulative short liquidation intensity on major CEXs will reach 1.356 billions. Note: The liquidation chart does not display the exact number of contracts pending liquidation or the precise value of contracts being liquidated. The bars on the liquidation chart actually represent the relative importance, or intensity, of each liquidation cluster compared to adjacent clusters. Therefore, the liquidation chart shows the extent to which the underlying asset price reaching a certain level will be affected. A higher "liquidation bar" indicates that when the price reaches that level, there will be a stronger reaction due to a wave of liquidity.

- 15:11Cardano Foundation Updates Roadmap: Plans to Focus on Supporting Stablecoins and RWA DevelopmentJinse Finance reported that the Cardano Foundation has updated its application roadmap, mainly including: 1. Providing up to eight figures worth of ADA liquidity for Cardano stablecoin projects; 2. Supporting the popularization and liquidity of DeFi through initiatives such as stablecoin DeFi liquidity budgets; 3. Delegating 220 million ADA tokens to new DReps; 4. Launching a real-world asset (RWA) project with a scale exceeding $10 million; 5. Allocating 2 million ADA tokens to the Venture Hub; 6. Expanding promotional activities and application adoption comprehensively. It is reported that the Cardano Foundation will discontinue its current SPO delegation strategy in the coming months and will subsequently delegate tokens to the Cardano Foundation pool.

- 14:36BlackRock earns $260 million in annual revenue through Bitcoin and Ethereum ETFsJinse Finance reported that data shared on Tuesday by Leon Waidmann, Head of Research at the nonprofit Onchain Foundation, shows that BlackRock's bitcoin and ethereum ETFs have a total annualized revenue of $260 million, with bitcoin ETFs contributing $218 million and ethereum products contributing $42 million. Waidmann stated that the profitability of BlackRock's crypto-themed ETFs may drive more investment giants from the traditional finance (TradFi) sector to launch regulated crypto trading products. BlackRock's crypto ETFs have become a "benchmark" for institutions and traditional pension funds. Meanwhile, according to blockchain data from Dune, BlackRock's total assets under management (AUM) have approached $85 billion, accounting for 57.5% of the US spot bitcoin ETF market share, firmly ranking first. In contrast, an ETF from another exchange holds only $22.8 billion in assets, ranking second in the US spot bitcoin ETF market with a 15.4% market share.