News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 20) | US to Release Nonfarm Payrolls and Unemployment Rate; Ethereum Advances Post-Quantum Cryptography; LayerZero and KAITO Tokens Face Major Unlocks Today2Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends33 SOL data points suggest $130 was the bottom: Is it time for a return to range highs?

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

CryptoSlate·2025/11/14 19:00

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

深潮·2025/11/14 18:42

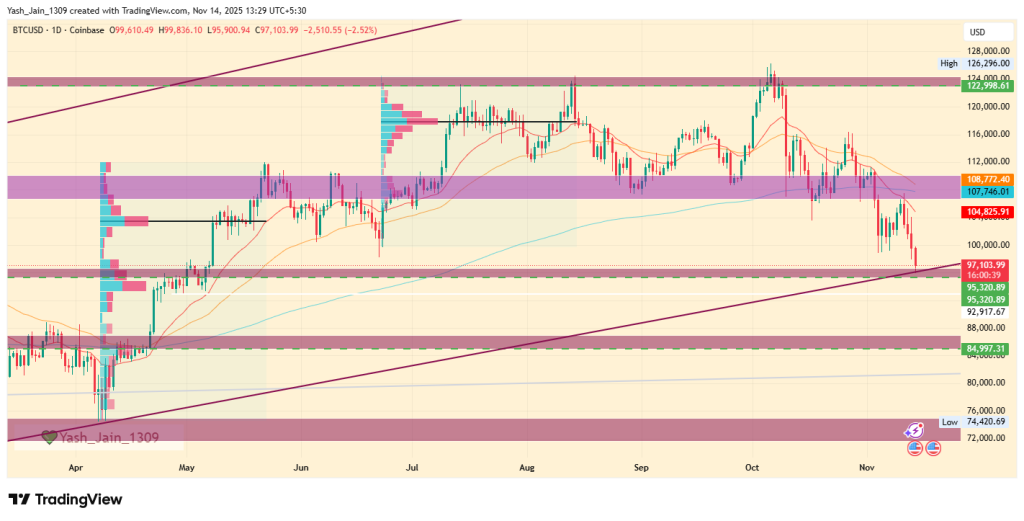

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

深潮·2025/11/14 18:40

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

深潮·2025/11/14 18:38

Grayscale formalizes its IPO filing

Cointribune·2025/11/14 18:06

Czech Bank Tests Crypto Assets In Pilot Program

Cointribune·2025/11/14 18:06

New XRP ETF Draws $58M Trading Volume, Tops This Year’s ETF Debuts

Cointribune·2025/11/14 18:06

Bitzuma Launches Research & Education Hub to Elevate Crypto Knowledge

DeFi Planet·2025/11/14 18:03

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Coinpedia·2025/11/14 17:42

Why Crypto Is Down Today [Live] Updates On November 14,2025

Coinpedia·2025/11/14 17:42

Flash

- 18:37Data: If ETH breaks through $2,960, the cumulative short liquidation intensity on major CEXs will reach $1.24 billion.According to ChainCatcher, citing data from Coinglass, if ETH breaks above $2,960, the cumulative short liquidation intensity on major CEXs will reach $1.24 billion. Conversely, if ETH falls below $2,684, the cumulative long liquidation intensity on major CEXs will reach $481 million.

- 18:05Goolsbee: Uncomfortable with an early and significant rate cutAccording to Golden Ten Data, ChainCatcher reported that Federal Reserve's Goolsbee stated he feels uneasy about making large interest rate cuts in advance and relying on the assumption that inflation is only temporary.

- 17:53Federal Reserve Governor Cook warns of risks in private credit and urges central banks to focus on systemic vulnerabilitiesJinse Finance reported that Federal Reserve Governor Cook stated that, given the "increased complexity and interconnectedness of leveraged companies," officials should monitor how unexpected losses in private credit could spread to the broader US financial system. She added that recent bankruptcies of private companies in the automotive industry have also exposed unexpected losses and exposures among a wide range of financial entities, including banks, hedge funds, and specialized financial firms. Her remarks echoed the concerns of Federal Reserve Governor Barr, who earlier this week said he viewed private credit as a potential risk area. Cook also said on Thursday that she considers the expanding footprint of hedge funds in the US Treasury market and asset valuation levels as potential vulnerabilities. Cook stated that despite high asset values, the growth and complexity of the private credit market, and the potential vulnerability of hedge fund activities possibly causing turmoil in the Treasury market, the financial system remains resilient. She said: "These emerging vulnerabilities are also occurring against the backdrop of very significant technological changes, which may ultimately improve financial stability, but also involve transitional periods and potential challenges that may require thoughtful and prudent responses."