News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Chainlink partners with U.S. Commerce Department to bring real-time GDP, PCE data on-chain via Ethereum, Avalanche, and Optimism. - Programmable data feeds enable DeFi protocols to adjust risk parameters and prediction markets to price inflation-linked derivatives dynamically. - Initiative breaks down traditional data silos by making economic metrics immutable, globally accessible, and directly integrable into smart contracts. - U.S. government's blockchain adoption aligns with broader crypto innovation

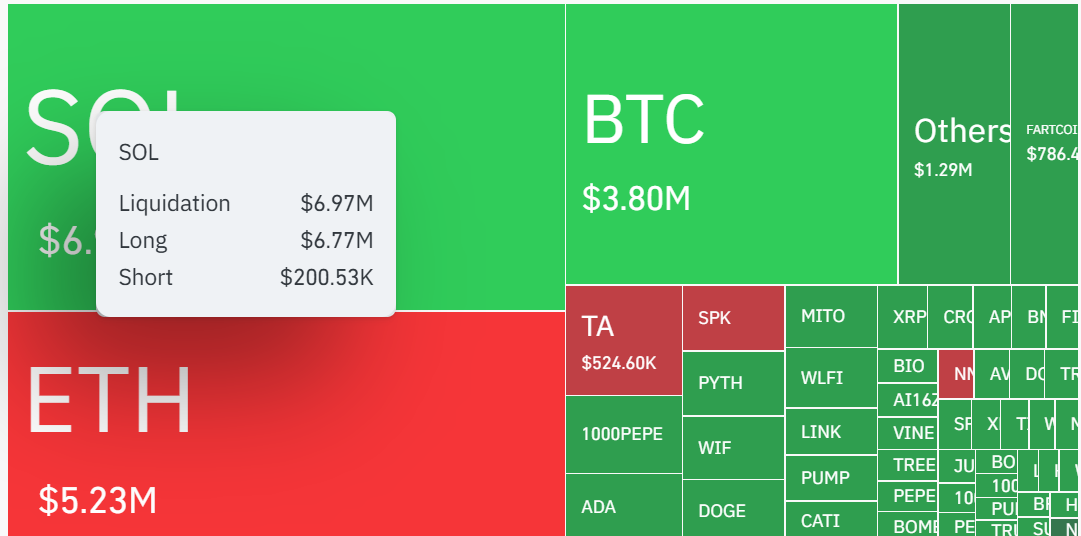

- Solana (SOL) gains institutional traction with 91% ETF approval chance by 2025, targeting $335 as inflows and upgrades drive adoption. - Institutional staking of $1.72B and partnerships with R3/PayPal expand Solana’s utility beyond DeFi, boosting demand. - Strong RSI/MACD and $23M whale staking signal bullish momentum, supported by 7,625 new developers and Alpenglow upgrades. - Despite risks like outages and Ethereum competition, Solana’s scalability and institutional-friendly infrastructure position it

- NMR surged 240% in 24 hours to $10.85, driven by upgraded on-chain liquidity mechanisms and a new AMM boosting cross-chain swaps and DeFi utility. - Institutional and retail investors flocked to NMR as the AMM improved price discovery and slippage, supported by a recent smart contract audit. - Technical indicators show NMR breaking key resistance, with RSI overbought but MACD bullish, as traders watch the $8.20–$11.50 range for potential pullbacks. - Strong on-chain accumulation, stable long-term holders

- AirNet Technology raised $90M in digital assets (819.07 BTC, 19,928.91 ETH) via a registered direct offering, shifting to a crypto-backed hybrid model. - The deal, accepting digital assets instead of fiat, restructures AirNet’s balance sheet and business model, offering shareholders equity and crypto exposure. - The company hires crypto experts to actively manage assets, positioning itself as a rare public crypto fund amid regulatory and volatility risks. - Institutional adoption and reduced Bitcoin vola

- Gryphon Digital Mining shareholders approved a merger with American Bitcoin, creating a Nasdaq-listed entity under ticker ABTC via a stock-for-stock deal. - A 5-for-1 reverse stock split reduced shares from 82.8M to ~16.6M to meet Nasdaq bid price rules, with automatic rounding of fractional shares. - American Bitcoin, rebranded from a data center firm, aims to build a BTC treasury and leverages the merger to bypass IPO for public market access. - Post-merger volatility saw Gryphon's stock drop 10.5% aft

- 22:23Marusho Hotta renamed to "Bitcoin Japan Corporation" and announces plans to launch a Bitcoin treasury strategyAccording to Jinse Finance, as disclosed by BitcoinTreasuries.NET, the Japanese traditional kimono manufacturer Marusho Hotta, with a history of 150 years, has changed its name to "Bitcoin Japan Corporation" and announced plans to launch a Bitcoin treasury strategy.

- 22:22Bank of England Governor emphasizes the importance of stablecoins accessing central bank accountsForesight News: According to Jinse Finance, Bank of England Governor Bailey stated that in the future, any widely used stablecoin in the UK should be able to access Bank of England accounts to consolidate its status as a form of money.

- 22:22US-listed VisionSys AI to partner with Marinade Finance to launch a $2 billion SOL treasury programForesight News reports that VisionSys AI Inc. (NASDAQ: VSA), a technology service company focused on brain-computer interfaces and advanced AI systems, announced that its wholly-owned subsidiary Medintel Technology Inc. has reached an exclusive cooperation framework with Marinade Finance to jointly launch a Solana-based digital asset treasury program with a scale of $2 billion. This milestone collaboration aims to strengthen VisionSys's balance sheet, enhance liquidity, and create long-term value for shareholders through strategic allocation and staking of Solana (SOL). The first phase of the plan is to complete the acquisition and staking of $500 million worth of SOL within the next six months.