News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Divergent Share Moves May Signal Risks for Bitcoin-Focused Crypto Treasury Companies2Dogecoin ETF Approval: Can DOGE Price Hit $0.50 and Surge Toward $1 Next?3Three-Stage Script of the Crypto Market: Short-Term Volatility, Mid-Term Boom, Long-Term Concerns — Cycle Analysis of BTC, ETH, and Altcoins

First Neiro on Ethereum (NEIRO) To Rise Higher? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/08/08 16:50

Render (RENDER) Soars Higher While Tracing a Familiar Pattern – What Could Come Next?

CoinsProbe·2025/08/08 16:50

Ethereum Price Prediction: Can BlackRock’s $103M Buy Push ETH to $4,000?

Cryptoticker·2025/08/08 16:40

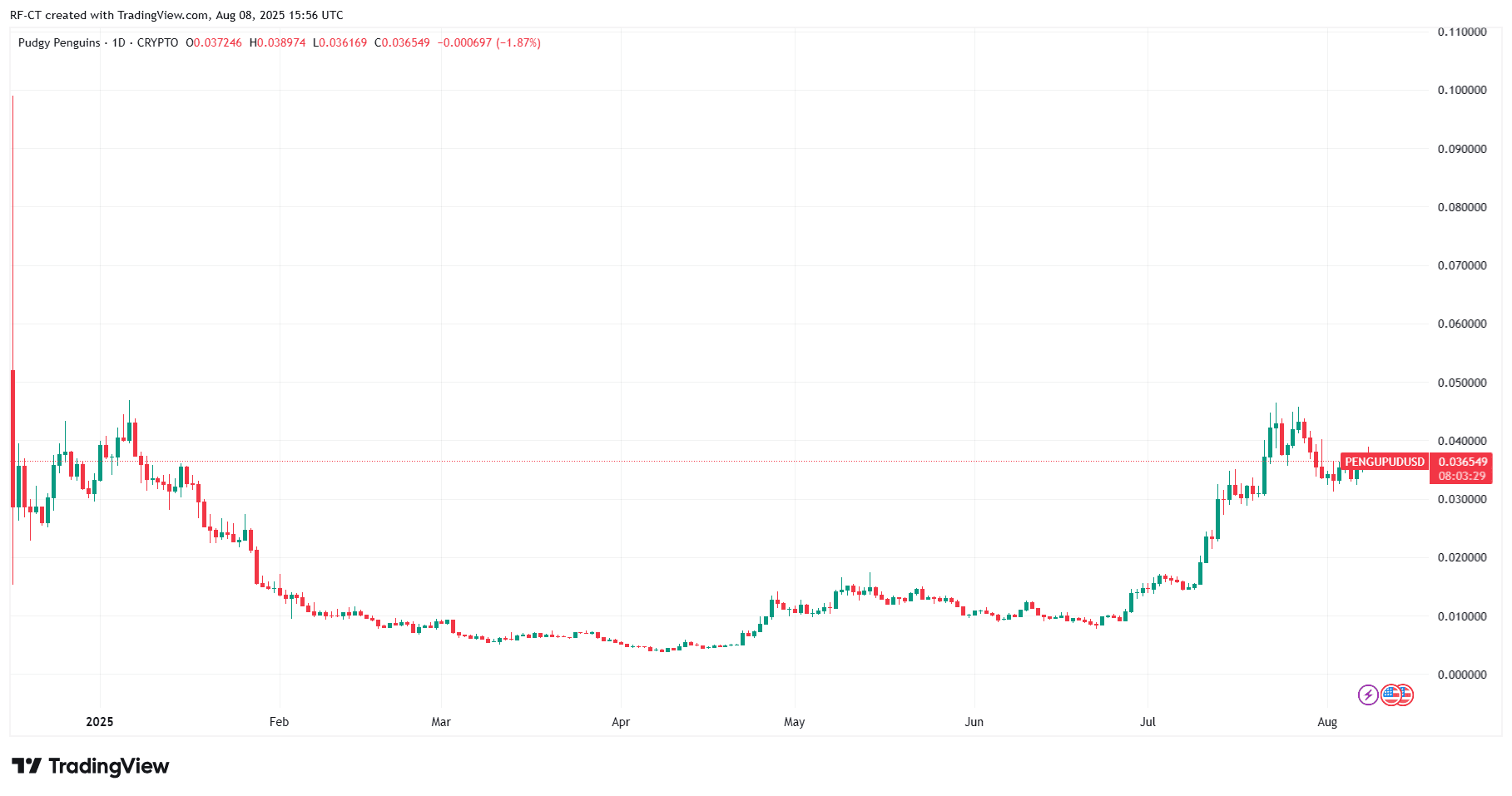

PENGU Surpasses BONK: Can Solana’s Meme Coin Star Break Into the Top 3 by 2025?

Cryptoticker·2025/08/08 16:40

Harvard Enters the Crypto Market With BlackRock’s Bitcoin ETF

Harvard University invested $116.6 million in BlackRock's Bitcoin ETF in Q2 2025, marking its largest Web3 commitment and surpassing Alphabet in portfolio size.

BeInCrypto·2025/08/08 16:37

Ethereum Treasury Companies Are a Better Buy Than US Spot Ether ETFs, Standard Chartered Says

Cointime·2025/08/08 16:25

Vitalik backs Ethereum treasury firms, but warns of overleverage

Cointime·2025/08/08 16:25

Chainlink Unveils LINK Reserve Strategy. Is a Supply Shock Incoming?

DailyCoin·2025/08/08 16:00

After Bo Hines’ departure, who’s the next big shot in the White House?

Kriptoworld·2025/08/08 16:00

Flash

- 14:49Analyst: A company raised $375 million on-chain, with funding sources including institutions such as Galaxy Digital.ChainCatcher news, according to a post forwarded by Arkham analyst Emmett Gallic, a certain company has just raised $375 million on-chain. An Ethereum address received $375 million in USDT and USDC through multiple different entities, including Galaxy Digital, Josh Fraser, Hypersphere Ventures, Robert Leshner, and other well-known institutions in the cryptocurrency ecosystem.

- 14:45Goldman Sachs Trader: Beware Economic Data Cracks Halting U.S. Stock RallyJinse Finance reported that a macro trader at Goldman Sachs stated that investors need to remain vigilant over the next 12 months to identify which economic data may pose a threat to this record-breaking stock market rally. Paul Chervone of the bank pointed out that employment market data will play a key role in providing early warnings of economic cracks. He cited data from the New York Fed, noting that while the probability of unemployment remains low, once unemployed, workers now have only a 45% chance of finding a new job—the lowest estimate on record. The S&P 500 Index hit another all-time high on Wednesday. However, the U.S. labor market, fiscal spending, and potentially excessive optimism about artificial intelligence in the market have prompted caution among some seasoned market participants. Chervone previously stated that the market is underpricing recession risks. "I won't short the bubble prematurely, but I also won't ignore the cracks," he wrote.

- 14:42USYC is now listed on the Aave Horizon RWA market as collateralForesight News reported that USYC, launched by Circle, has been listed on the Aave Horizon RWA market as collateral. USYC is a tokenized money market fund that provides yield-bearing collateral and supports large-scale, near-instant redemption functionality.