WLFI sees a 36.4% increase today despite experiencing a significant downward trend over the long term

- WLFI surged 36.4% in 24 hours to $0.1936 but fell 2077.18% over seven days amid prolonged bearish trends. - Technical indicators show oversold conditions (RSI/MACD) conflicting with bearish long-term moving averages. - A backtesting strategy using RSI and 50-day SMA aims to capture short-term reversals in WLFI's volatile market. - Weak on-chain activity and absent fundamentals suggest the rally lacks sustainability without new catalysts.

On September 26, 2025,

This notable single-day increase stands out as an outlier amid a broader backdrop of waning investor confidence and ongoing capital withdrawals. The dramatic price swings highlight the extreme volatility and vulnerability of the WLFI market. Although the 24-hour surge has generated some temporary optimism, it has not been enough to change the overall negative direction seen in recent weeks and months. Investors remain attentive to whether this brief uptick marks a potential bottom or simply a short interruption in an ongoing decline.

Technical analysis currently presents conflicting signals. Both the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) indicate that WLFI could be entering oversold territory, suggesting a possible short-term rebound. However, the long-term Moving Averages, particularly the 200-day MA, continue to slope downward, signaling ongoing bearishness. This contrast underscores the market’s uncertainty and the likelihood of continued price fluctuations in either direction.

WLFI’s price movements are increasingly shaped by broader economic sentiment and overall market cycles. While the recent daily gain is technically encouraging, it has not been matched by a rise in on-chain activity or trading volume, raising questions about the durability of the rally. Without strong fundamentals or clear catalysts, the upward move may be fleeting unless new factors emerge to shift investor outlook.

Backtest Hypothesis

A backtesting approach has been suggested to evaluate whether a systematic trading method could yield profits in WLFI’s turbulent market. This strategy uses a combination of the RSI and a 50-day Simple Moving Average (SMA). The main idea is to take long positions when the RSI drops below 30 (signaling oversold conditions) and the price is above the 50-day SMA. Conversely, short positions are opened when the RSI rises above 70 (indicating overbought conditions) and the price falls below the 50-day SMA.

Positions are closed when the RSI moves back into the neutral range (between 30 and 70) or when the price crosses the 50-day SMA in the opposite direction. Stop-loss and take-profit points are set dynamically, based on the average true range over the previous 14 days.

The premise is that this method could potentially take advantage of short-term reversals in a highly volatile setting like WLFI’s. With the asset’s recent 36.4% daily jump amid a prolonged downtrend, the backtest aims to determine if the strategy would have benefited from the latest price action or struggled to keep up with the rapid momentum shifts. If proven effective, this approach could provide guidance for trading in markets where sentiment, rather than fundamentals, drives price swings.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

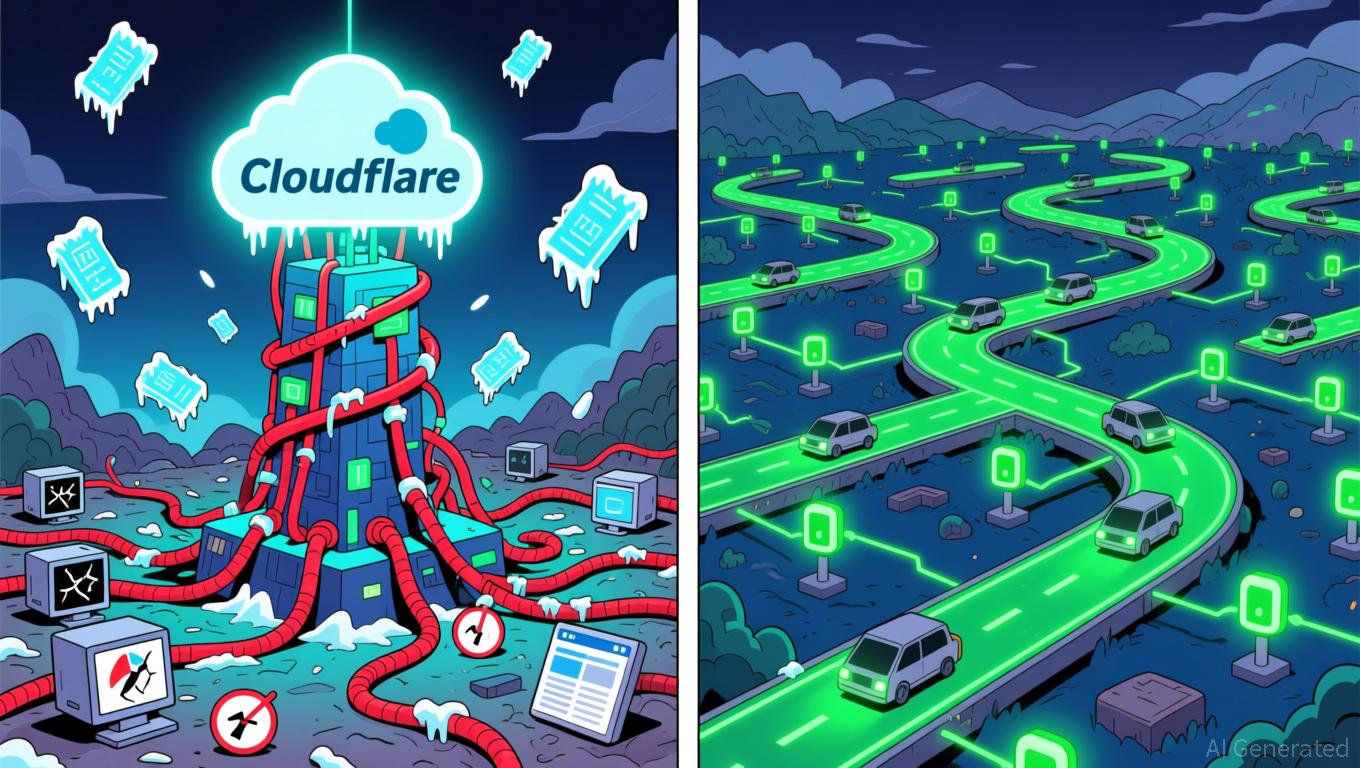

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -