SEC's endorsement of in-kind transactions connects digital assets with conventional financial markets, drawing increased interest from institutional investors

- SEC approves in-kind creation/redemption for crypto ETPs, aligning them with traditional commodity ETFs to boost efficiency and institutional adoption. - This shift reduces transaction costs and slippage by enabling direct asset exchanges (e.g., Bitcoin/Ethereum) instead of cash-based mechanisms. - BlackRock’s IBIT ETF sees strong inflows, while decentralized exchanges like Aster surge in volume, signaling maturing DeFi infrastructure and regulatory clarity. - Analysts predict accelerated institutional a

The U.S. Securities and Exchange Commission (SEC) has made a significant move to bring crypto asset markets closer to mainstream standards by approving in-kind creation and redemption processes for exchange-traded products (ETPs). This decision is anticipated to boost operational efficiency and draw more institutional investors. By aligning crypto ETPs with conventional commodity ETFs, authorized participants can now swap underlying assets such as

This approval is part of a broader SEC initiative to modernize the regulatory landscape for crypto products, including raising position limits for Bitcoin options and considering ETPs that hold multiple asset types. These efforts are designed to encourage greater market involvement and respond to the increasing institutional demand for crypto investments. For example, BlackRock’s iShares Bitcoin Trust (IBIT), currently the largest spot Bitcoin ETF, has attracted substantial capital inflows. The adoption of in-kind redemptions could further enhance its attractiveness by lowering tax implications and improving price tracking.

Meanwhile, competition among decentralized exchanges (DEXs) is heating up, with platforms like Hyperliquid and Aster battling for leadership in perpetual futures trading. Bitwise Asset Management has recently submitted an application for a spot ETF based on Hyperliquid’s native token (HYPE), while Aster has experienced a dramatic rise in both open interest and trading volume, overtaking Hyperliquid in daily statistics. Aster’s open interest soared by 33,500% within a week to reach $1.25 billion, and its 24-hour trading volume climbed to $24.7 billion, surpassing Hyperliquid’s $10 billion. Despite this, Hyperliquid still leads in long-term liquidity, recording $300 billion in 30-day perpetual trading volume. These trends point to a more mature DeFi sector, where robust infrastructure and clearer regulations could pave the way for wider adoption.

The SEC’s recent endorsement of in-kind redemptions also resolves previous inefficiencies in crypto ETF operations. Previously, spot Bitcoin and Ethereum ETFs were restricted to cash-based transactions, which posed operational challenges compared to traditional commodity ETFs. The transition to in-kind processes removes the need for open-market purchases, thereby minimizing slippage and reducing transaction fees. Experts, including Bloomberg’s James Seyffart, believe this adjustment will speed up institutional participation, with leading ETF issuers such as

Market momentum is further fueled by increasing ETP investments and a regulatory climate that is becoming more supportive of crypto advancements. Although Bitcoin’s price outlook for the fourth quarter remains uncertain, the combination of improved ETF mechanisms, rising DeFi activity, and growing institutional interest sets a positive stage. The SEC’s recent measures, along with the evolution of decentralized trading platforms, signal a broader acceptance of crypto assets in mainstream finance. As the industry evolves, investors could benefit from greater liquidity and lower costs, potentially sparking a surge in Bitcoin and other cryptocurrencies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

El Salvador Buys Bitcoin Dip, Expands Reserves Amid IMF Pressure

Aster News Today: Transparent Token Unlocks Fuel 9% Surge for Aster, $1.38 Target in Focus

- ASTER surged 9% to $3.27B market cap after team clarified tokenomics and Binance's CZ disclosed $2.5M holdings. - Misstated unlock schedules and a $10M trading competition fueled demand, with price stabilizing above $1.14. - Analysts highlight $1.38 target if $1.26 resistance holds, but warn of risks from stagnant fees and declining user growth.

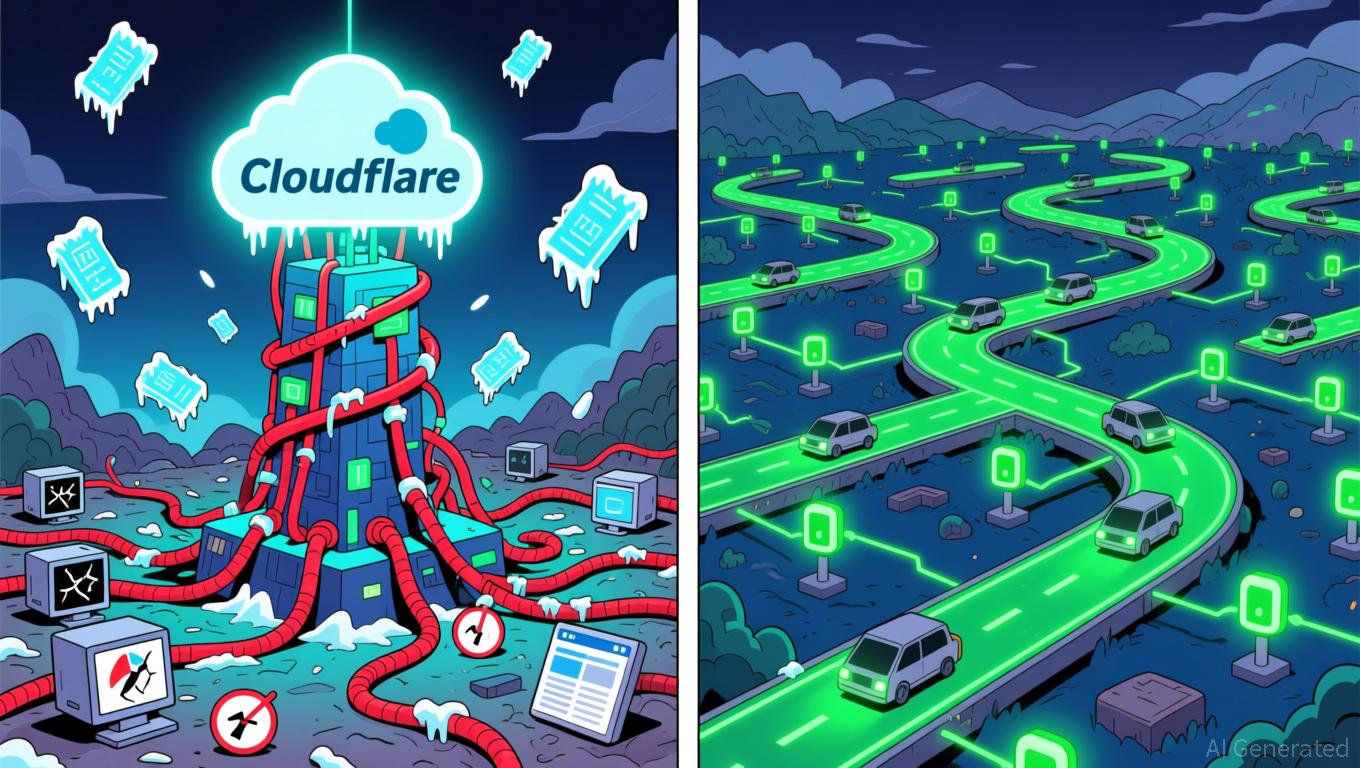

Bitcoin News Update: Recent Cloud Outages Highlight Systemic Risks, Fueling DePIN Adoption

- Cloudflare's 2025 global outage disrupted major websites and crypto platforms, exposing centralized infrastructure vulnerabilities and boosting DePIN interest. - The incident caused 500 errors and API failures, impacting services like ChatGPT, X, and crypto exchanges, while pushing Cloudflare's stock down 3.5%. - DePIN advocates argue decentralized infrastructure reduces single-point failures, with projects like Gaimin promoting distributed cloud models using global resources. - Blockchain's operational

Bitcoin Updates Today: Is Bitcoin's Decline a Temporary Correction or the Start of a Crash? Experts Disagree

- Bitcoin's recent sharp price swings, dipping below $90,000 before rebounding to $96,500, have intensified debates over bear market risks versus bull cycle consolidation. - MicroStrategy's CEO Michael Saylor denied Bitcoin sales, reaffirming accumulation strategies as institutional ETF redemptions hit $870M, signaling bear market concerns. - Technical analysts highlight critical $92,000–$95,000 support zones, with breakdown risks pushing prices toward $85,000–$90,000 amid deteriorating market sentiment. -