U.S. Trade Barriers Clash with International Markets: Impact Felt by India, Japan, and Cryptocurrency

- Trump's 500% tariff proposal on Russia's trade partners shocks global markets, targeting India (€3.1B Russian energy imports) and China (€5.8B) as most vulnerable economies. - India's energy diversification plans face disruption as U.S. tariffs threaten its Russian crude imports and LPG deals, despite government efforts to reduce dependence. - Japan's economy contracts 1.8% amid U.S. trade policies, with 15% tariffs on exports and Trump's protectionism undermining bilateral trade momentum. - DeFi sector

Donald Trump's recent support for a comprehensive bill proposing tariffs as high as 500% on nations conducting trade with Russia has rattled international markets, putting India and China at particular risk. The initiative,

These proposed tariffs would add to an existing 50% duty on Indian imports, which already includes a 25% fee on crude oil,

Japan, another significant U.S. ally, is already feeling the consequences of Trump’s trade approach. The Japanese economy

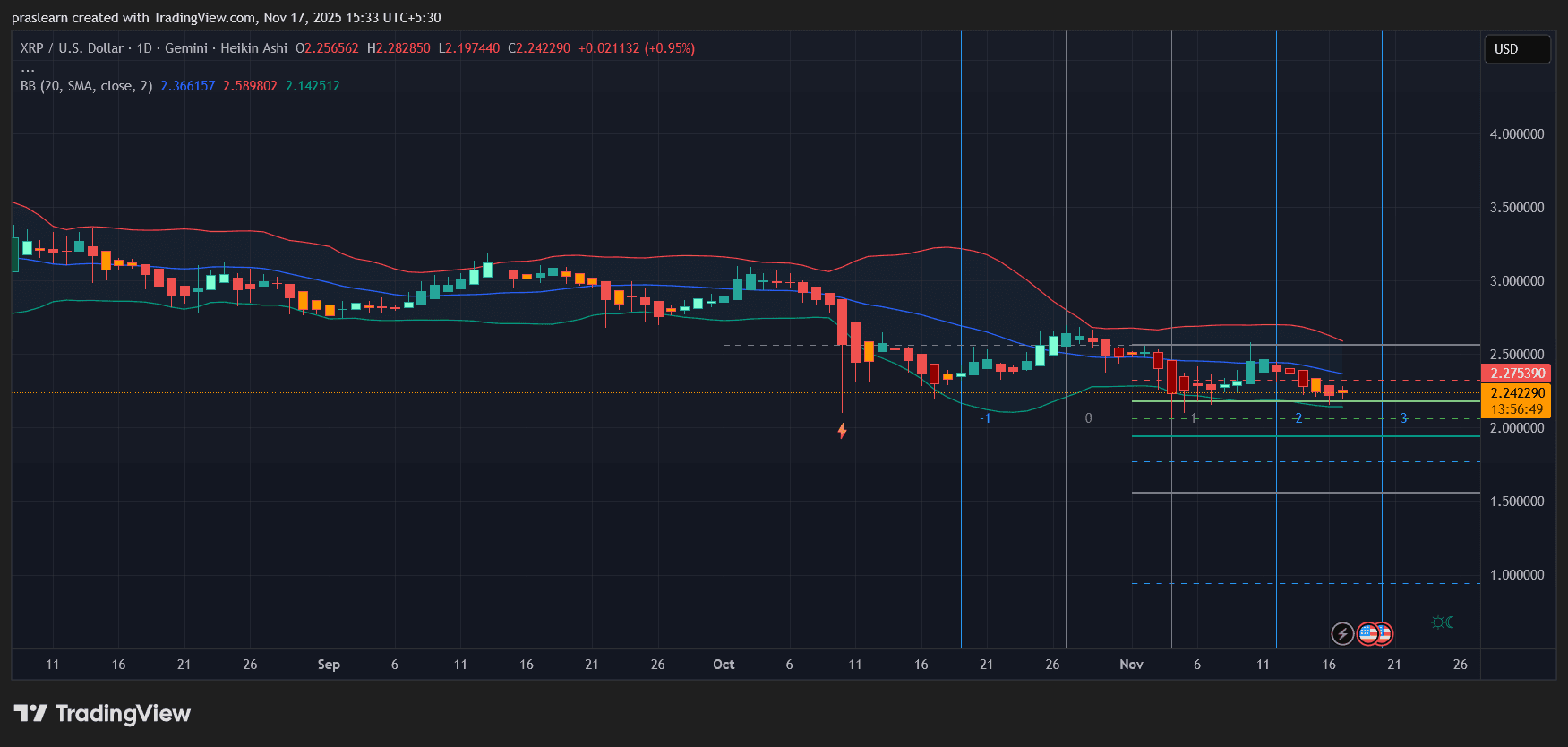

At the same time, the cryptocurrency sector has experienced significant volatility.

The economic impact goes beyond just energy and digital assets.

With the U.S. ramping up economic sanctions on Russia, the global economy faces mounting instability. As key partners like India and Japan struggle and cryptocurrency markets tumble, the outlook remains highly uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Major Events This Week That Could Move Crypto and Stocks

Will XRP Price Crash to 0.65?

Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

Strategy Adds $836M in Bitcoin