Cash-Heavy Amazon Takes on $12B in Debt: AI Competition Drives Tech Titans to Borrow

- Amazon plans to raise $12B via bonds to fund AI/data center expansion, its first major issuance since 2021. - JPMorgan projects AI-related capex will hit $150B by 2026, straining cash flow despite $84B in reserves. - Tech giants increasingly rely on debt financing as AI investments outpace organic cash generation. - JPMorgan forecasts $1.5T in new tech bonds over five years, signaling a "generational shift" in corporate finance.

Amazon.com Inc. (NASDAQ:AMZN) is set to secure around $12 billion through a corporate bond sale in the United States,

Although Amazon holds a strong financial position with $84 billion in cash and marketable securities against $58 billion in liabilities, the heavy investment required for its AI strategy is putting strain on its balance sheet

This bond sale highlights a larger movement in corporate finance, with technology companies increasingly relying on debt to drive innovation. JPMorgan anticipates that major tech firms will issue $1.5 trillion in new investment-grade bonds over the coming five years, marking what it calls a "generational shift" in Silicon Valley's approach to funding growth

---

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Major Events This Week That Could Move Crypto and Stocks

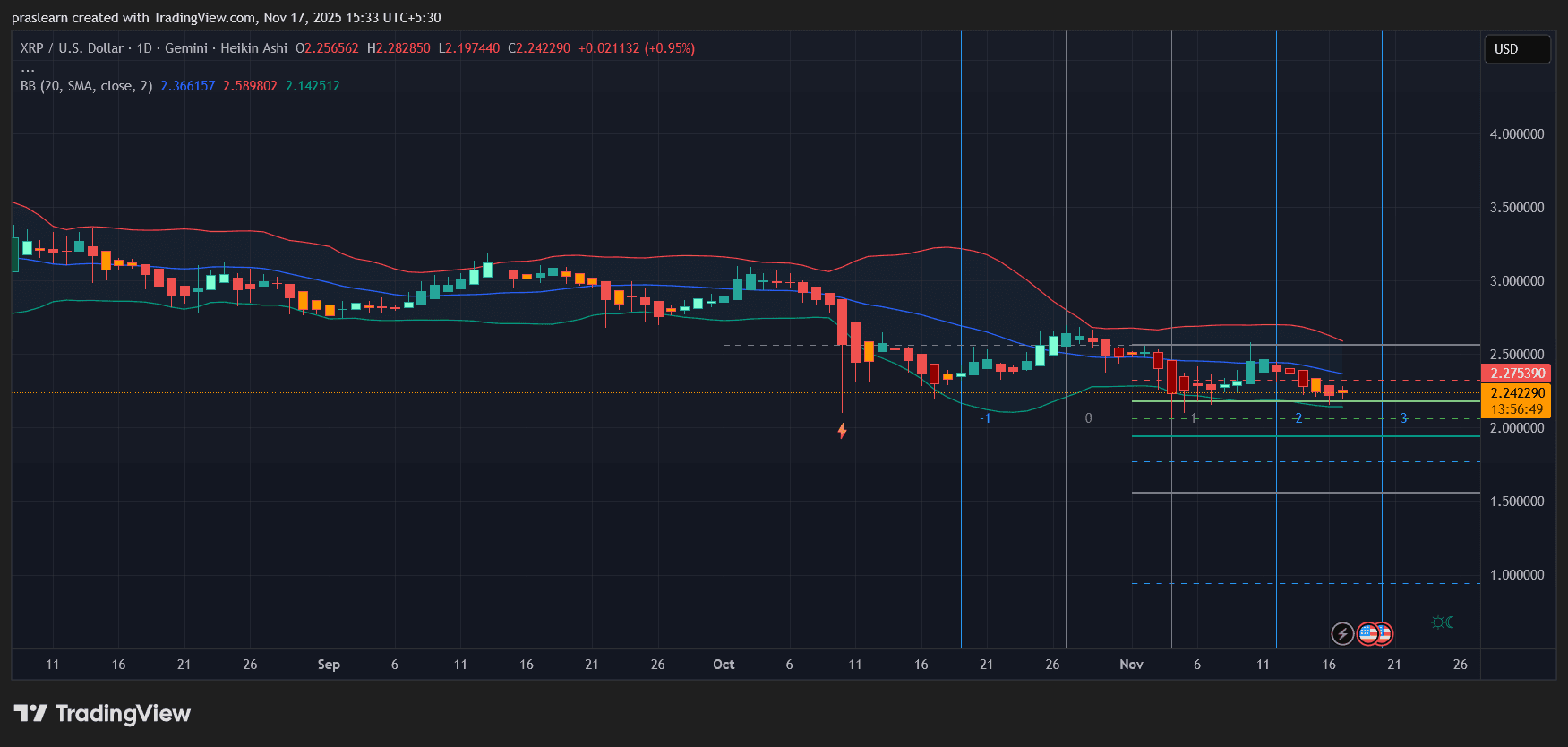

Will XRP Price Crash to 0.65?

Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

Strategy Adds $836M in Bitcoin