Bitcoin Updates: Institutions Access Crypto Without Rollover Hassles Through Cboe’s Latest Futures

- Cboe launches Bitcoin/Ether Continuous Futures on Dec 15, offering U.S.-regulated perpetual crypto exposure with no rollover needs. - Contracts trade 23/5, settle via CFTC-regulated Cboe Clear U.S., and use Kaiko rates for transparency in fragmented markets. - Products address institutional demand for long-term crypto access, competing with offshore "bucket shops" through regulatory oversight. - Cboe emphasizes streamlined risk management and cross-margining with existing FBT/FET futures to enhance capit

Cboe Global Markets, Inc. (CBOE) is preparing to shake up the crypto derivatives sector with the introduction of its

The Continuous Futures, named Cboe Bitcoin Continuous Futures (PBT) and Cboe Ether Continuous Futures (PET), come with a 10-year expiry at the time of listing and feature daily cash adjustments to keep prices in line with their underlying assets

This rollout is in step with broader shifts in the industry.

To encourage participation, Cboe's Options Institute will conduct educational events on December 17, 2025, and January 13, 2026, focusing on contract structure and practical applications

This development signals a strategic shift for Cboe in a highly competitive environment. While the company

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Major Events This Week That Could Move Crypto and Stocks

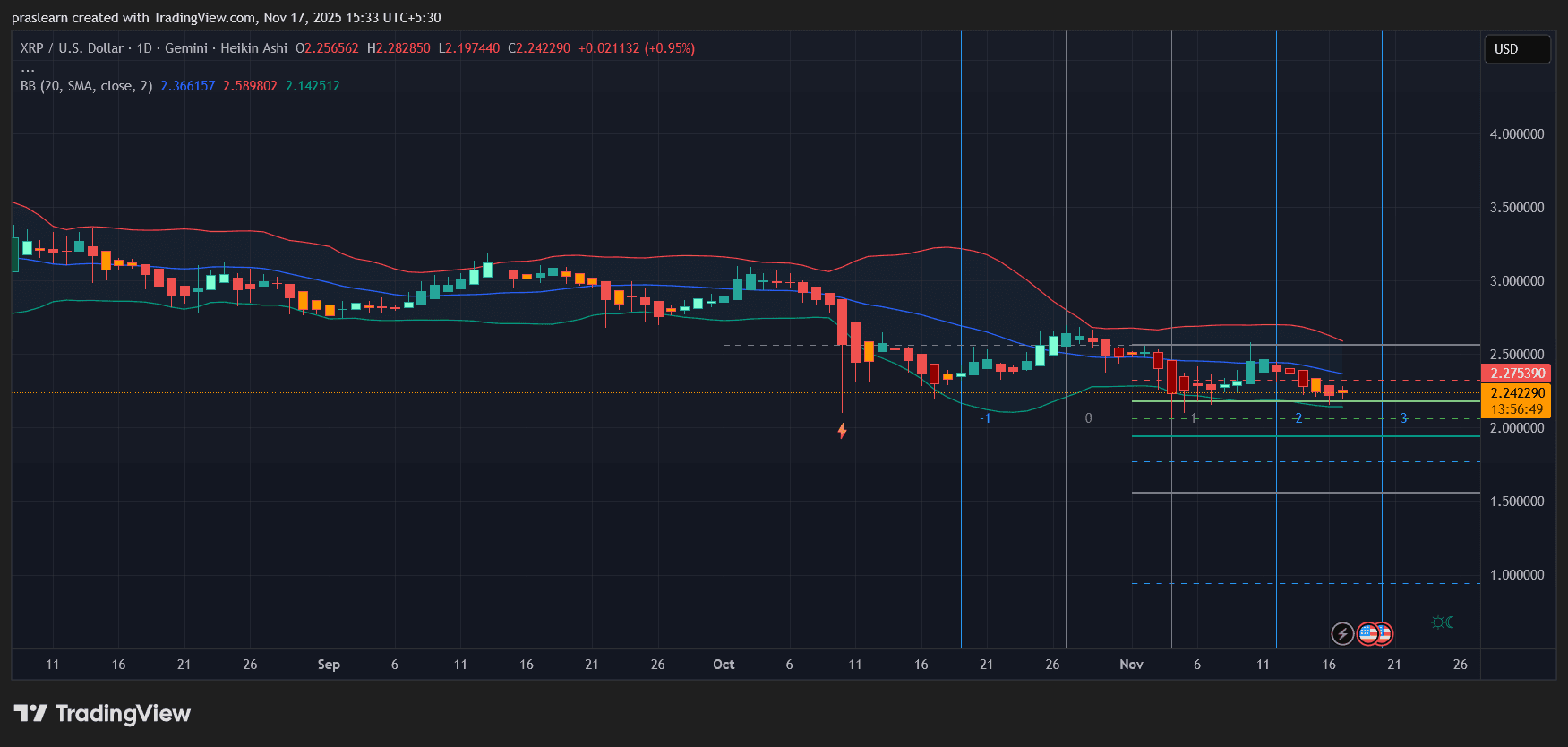

Will XRP Price Crash to 0.65?

Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

Strategy Adds $836M in Bitcoin