Japan Tackles Creative Fatigue While U.S. Investors Shift Tech Investments Due to AI Market Fluctuations

- Japan's government targets creative sector overwork under "Cool Japan" strategy, aiming to quadruple overseas content sales to ¥20 trillion by 2033. - U.S. investors reshaped 2025 Q3 portfolios, with Coatue and Duquesne Family Office shifting stakes in AI firms and tech giants amid market volatility. - Philip Morris attracted mixed investment despite weak financial metrics, with $104M inflows contrasting Coatue's full exit and high payout risks. - Divergent approaches highlight global economic trends: Ja

The Japanese government has introduced fresh initiatives to tackle excessive working hours within the creative industries, while high-profile investors in the United States have been actively rebalancing their holdings, illustrating differing strategies for economic stability in 2025.

Kimi Onoda, the minister responsible for Japan’s cultural exports, has vowed to enhance labor conditions for those in creative fields as part of the "Cool Japan" initiative, a cornerstone of Prime Minister Shigeru Ishiba’s economic policy. In an interview with

Philip Morris International (PM), a major tobacco company, experienced varied investor responses. Coatue completely sold its 1.29 million-share stake, while

The contrast in investment tactics reflects broader economic patterns. Japan’s efforts to safeguard creative professionals are in step with global moves to combat burnout, while U.S. investors are navigating a landscape where AI and pharmaceuticals remain contentious. As Ishiba’s administration schedules a policy meeting for 3 a.m.—a decision criticized for contradicting its stance against overwork—investors are gravitating toward sectors seen as less vulnerable to regulatory changes.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

3 Major Events This Week That Could Move Crypto and Stocks

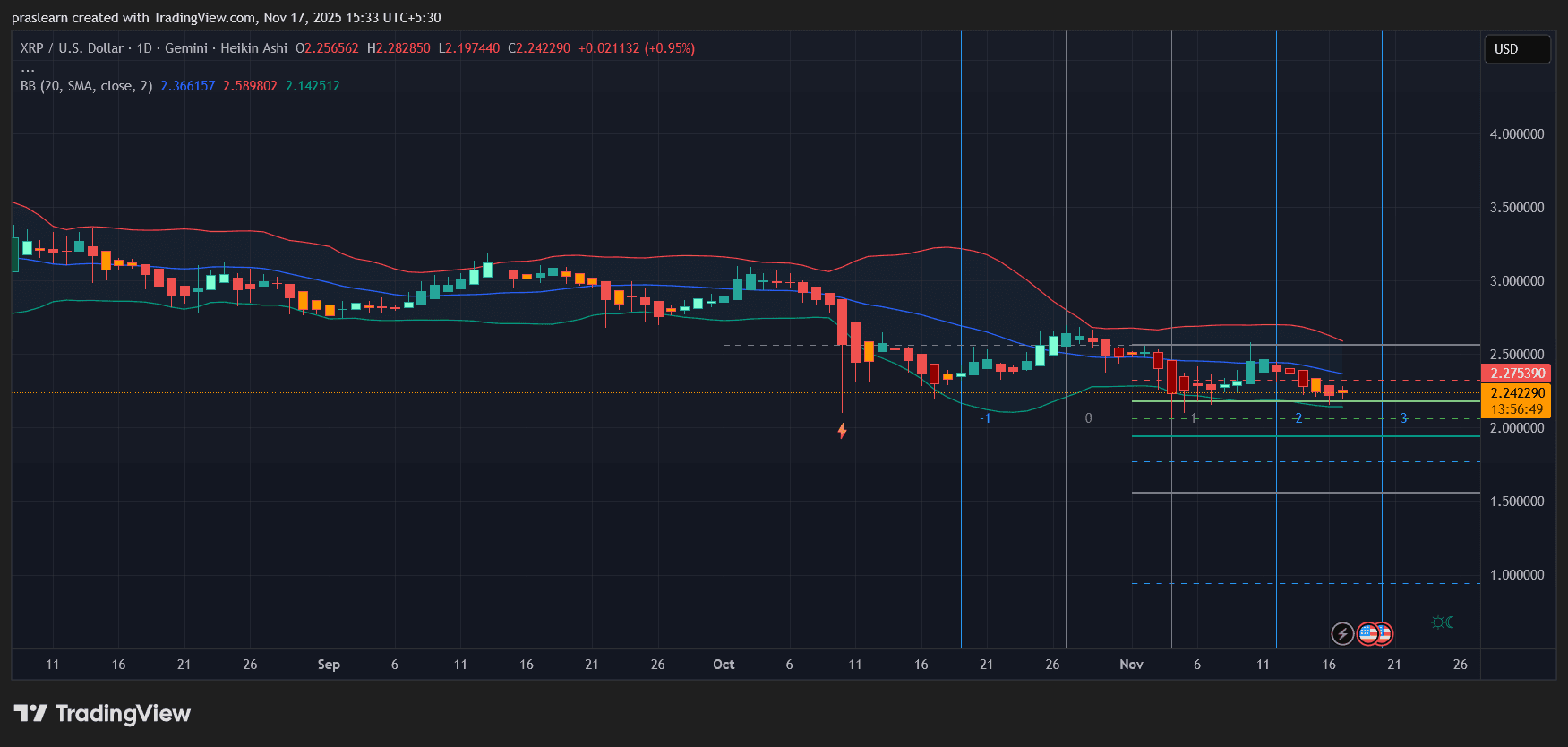

Will XRP Price Crash to 0.65?

Did McDonald’s Really See a Job Applicant Surge After the Crypto Crash?

Strategy Adds $836M in Bitcoin