News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Estimates show U.S. jobless claims fell to around 215,000 last week

Cointime·2025/10/17 14:48

Ethereum Price Slides Below $4,000 Support As Sellers Tighten Their Grip

Newsbtc·2025/10/17 14:27

Bitcoin falls below $110,000, whose wallet is losing money again?

Market sentiment has fallen into extreme fear.

ForesightNews 速递·2025/10/17 14:23

21Shares Files with SEC for 2x Leveraged HYPE ETF Tracking Hyperliquid Index Performance

Cryptonewsland·2025/10/17 14:06

Ghana Targets December 2025 for Crypto Rules as Enforcement Team Remains Unfilled

Cryptonewsland·2025/10/17 14:06

ACI Worldwide and BitPay Partner to Enable Merchants to Accept Crypto and Stablecoin Payments Globally

Cryptonewsland·2025/10/17 14:06

SEC’s Hester Peirce Calls for Financial Privacy as Tokenization Gains Momentum

Cryptonewsland·2025/10/17 14:06

France Boosts AML Checks on Crypto Exchanges

France’s ACPR tightens AML rules on crypto firms like Binance amid MiCA compliance efforts.Major Exchanges Face Regulatory ReviewMiCA Brings a New Compliance Era

Coinomedia·2025/10/17 14:06

Japanese banks to launch yen and dollar stablecoins

Portalcripto·2025/10/17 14:00

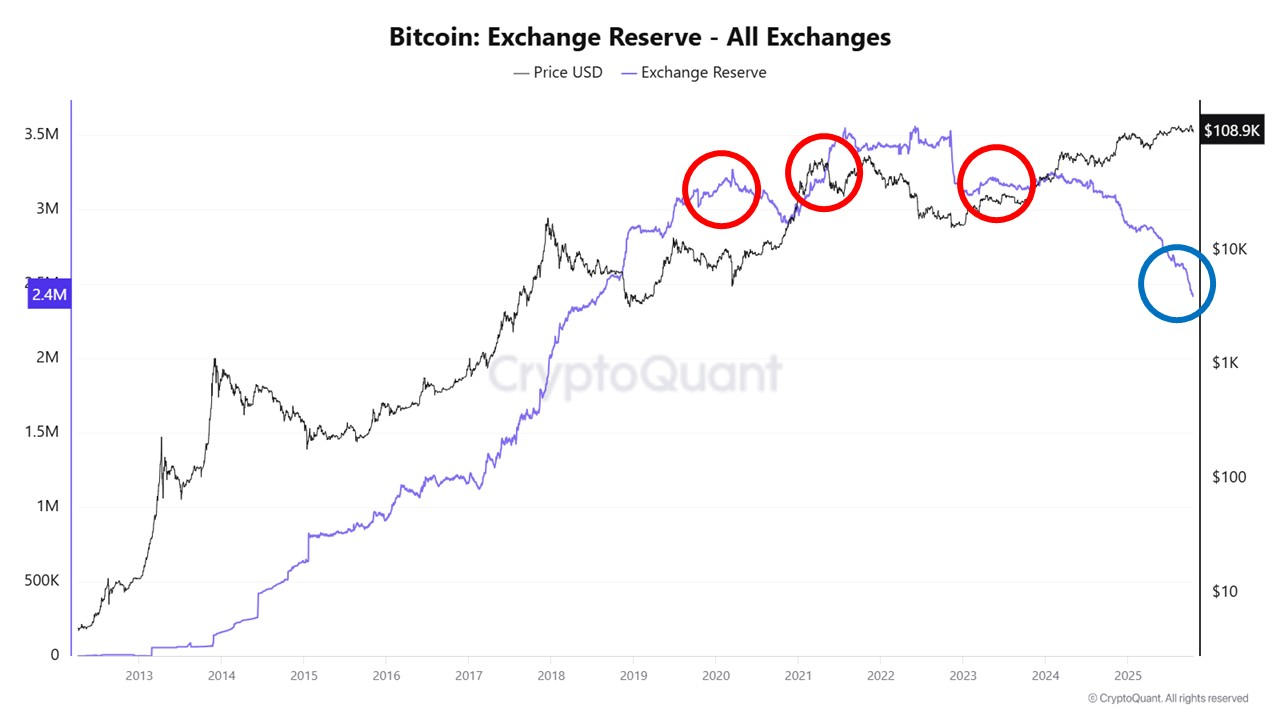

October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

CryptoNewsNet·2025/10/17 13:57

Flash

- 16:13Bitget has launched USDT-margined ZBT perpetual contracts with a leverage range of 1-20x.Foresight News: Bitget has announced the launch of the USDT-margined ZBT perpetual contract, with leverage ranging from 1 to 20 times. Contract trading for BOT is also now available. In addition, users can participate in CandyBomb. By completing specific contract trading volume tasks, users can unlock airdrop rewards, with a maximum of 500 ZBT per person and a total prize pool of 100,000 ZBT. The event runs until 21:30 on October 24. Detailed rules have been published on the official Bitget platform. Users must click the "Join Now" button to register and participate in the event.

- 16:12BTC surpasses $107,000According to Jinse Finance, market data shows that BTC has surpassed $107,000, currently trading at $107,019.99. The 24-hour decline has narrowed to 1.39%. The market remains highly volatile, so please manage your risks accordingly.

- 16:08Analysis: Whale groups remain stable this cycle, and an 80% bear market drop may no longer occurOn October 17, on-chain analyst Murphy released data showing that, as of today, whale wallets holding at least 100 BTC collectively own 12.17 million BTC, accounting for 61% of the total circulating supply. The number of BTC held by whales at the top of the 2021 bull market was similar to the current level, while at the top of the 2017 bull market it was around 10 million. In this cycle, many old OGs have handed over their chips to new institutions, resulting in a shift in the market participant structure. However, whether whales remain consistently optimistic or become fearful and anxious will still determine the transition between BTC bull and bear cycles. From 2017 to 2018, after BTC price reached $19,587 and began to retrace, whales realized daily losses of roughly $1 billion. Continuous, large-scale, and cost-agnostic sell-offs left the market with no time to recover, resulting in a bear market that lasted for a year and saw an 80% decline. From 2021 to 2022, the scale of daily realized losses reached a new level. On May 19, whales realized daily losses of $3 billion, and during the Luna crash, there was a terrifying record of $4 billion in a single day. In the previous cycle, consecutive daily realized losses exceeding $2 billion essentially marked the end of the bull market cycle. In the current cycle, on August 5, 2024, there was a single-day realized loss of $2 billion, which is so far the most severe panic sell-off of this cycle. In February and April 2025, influenced by Trump’s renewed tariff war, there were single-day losses of $1.1 billion and $800 million, respectively, which were much less severe than in August 2024. Recently, during the 1011 crash, BTC whales showed unusual composure and calm, with daily realized losses of only $400 million. The mentality and behavior of whales have become more stable, and the previous “year-long, 80% decline” bear market may no longer occur.