News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

In Brief Arthur Hayes rapidly ramps up altcoin purchases amid market optimism. His acquisitions include Ethereum, Pendle, Lido DAO, and Ether.fi. Market sentiment shifts to "greed" territory, aligning with Hayes’s strategic timing.

In Brief HBAR displays a sideways trend, declining 2% in 24 hours against market uptrends. Coinglass data shows $6.42 million outflows, indicating cautious investor sentiment. Technical indicators suggest continued weakening, with potential price pressure intensifying.

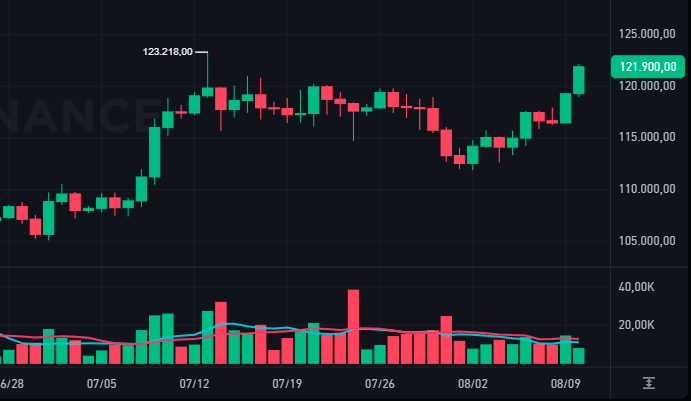

Whales have been accumulating Chainlink, Cardano, and PEPE in anticipation of the US CPI release, with LINK rising by 30%, ADA reaching a 14-day high, and PEPE seeing a 17% increase.

Global M2 money supply is climbing again, raising hopes for a potential Bitcoin price surge.Why M2 Matters for CryptoThe Road Ahead for BTC

Etherex sees a massive 503% TVL surge in 7 days, hitting $119.6M on Ethereum Layer 2 network Linea.What’s Driving the Surge?Implications for DeFi and Layer 2 Adoption

Large investors are scooping up millions in Chainlink, signaling rising confidence in LINK’s future.Millions Spent in Hours on LINKWhat This Means for the Market

- 16:56On-chain derivatives are transitioning from "experimental innovation" to emerging products that meet real market demand.According to Jinse Finance, data from Dune shows that on-chain derivatives contract trading volume has surged by more than 1000% over the past year. This trend not only reflects the growing market demand for on-chain derivatives protocols, but also marks a new stage of maturity for the broader DeFi ecosystem. After several market cycles, users' acceptance of decentralized trading experiences has significantly increased. On-chain derivatives are transitioning from "experimental innovation" to emerging products that meet real market needs.

- 16:13A new address went long on $41 million ENA, while simultaneously shorting $42 million worth of ETH and BTC for hedging.BlockBeats News, October 19, according to MLM monitoring, a newly created wallet address withdrew 3 million USDC from a certain exchange in the past two days, then deposited it into Hyperliquid, and opened a total ENA long position worth 41 million USD through two wallets, while simultaneously shorting 20 million USD of ETH and 22 million USD of BTC.

- 16:13Andrew Kang increased his short positions to $77.97 million, with unrealized losses of approximately $1 million.BlockBeats News, October 19, according to AI Aunt's monitoring, the short positions associated with Andrew Kang have increased to 77.97 million USD, including 46.86 million USD in ETH shorts and 31.14 million USD in BTC shorts. The total position is currently at a floating loss of 990,000 USD; meanwhile, his long position in ENA has a floating profit of 2.97 million USD.