News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin and Ethereum prices have experienced significant declines, with disagreements over Federal Reserve interest rate policies increasing market uncertainty. The mainstream crypto treasury company mNAV fell below 1, and traders are showing strong bearish sentiment. Vitalik criticized FTX for violating Ethereum’s decentralization principles. The supply of PYUSD has surged, with PayPal continuing to strengthen its presence in the stablecoin market. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The UK government plans to sell 61,000 seized bitcoins to fill its fiscal gap, which will result in long-term selling pressure on the market.

The article discusses a trading incident on the prediction market Polymarket following the end of the U.S. government shutdown. Star trader YagsiTtocS lost $500,000 by ignoring market rules, while ordinary trader sargallot earned more than $100,000 by carefully reading the rules. The event highlights the importance of understanding market regulations. Summary generated by Mars AI. This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

While the market is still chasing the ups and downs of "privacy coins," Vitalik has already placed privacy on the technical and governance roadmap for Ethereum over the next decade.

In an era where interest rates are below 0.5%, the Aave App aims to put 6% into the pockets of ordinary people.

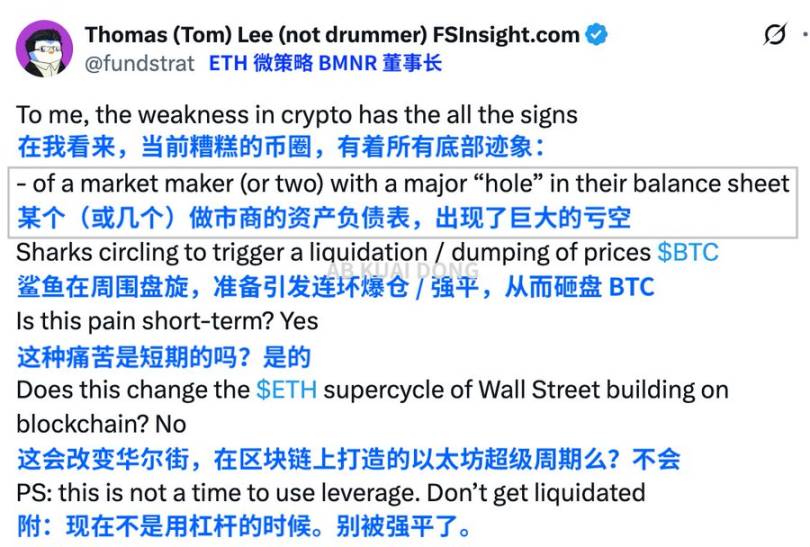

The crypto market experienced another "bullish death spiral" in mid-November.

In Brief Bitcoin's value drop triggers extensive market rebalancing. No significant shift towards altcoins observed amid major crypto declines. Blockchain activities do not indicate an impending altcoin season.

- 18:57US bank stocks are nearing key support levels, potentially signaling a warning for the broader stock marketChainCatcher news, according to Golden Ten Data, U.S. banks and financial stocks are on the verge of breaking through key support levels, sending a warning signal to the entire stock market. The weakness in this sector is driven by credit issues and traders reducing their bets on Federal Reserve rate cuts. The KBW Bank Index has fallen 4.5% over the past five trading days, while the S&P 500 Bank Index has recorded a 2.9% decline over the same period. Matt Maley, Chief Market Strategist at Miller Tabak, stated that if bank stocks continue to decline sharply in the next week or two, it will send a significant warning signal to the market.

- 18:54Saudi Arabia plans to deepen cooperation with major US tech giants and invest heavily in building multiple gigawatt-scale data centersAccording to a report by Jinse Finance, US financial media Semafor stated that Humain, an artificial intelligence company backed by Saudi Arabia's sovereign wealth fund, plans to announce a series of new agreements with US companies tomorrow, as the country is preparing to invest tens of billions of dollars to implement a plan aimed at becoming the world's third-largest artificial intelligence nation. Sources revealed that Humain is planning to collaborate with companies including Amazon, AMD, xAI, and GlobalAI to announce the construction of multiple gigawatt-scale data centers. The sources said these agreements are expected to follow US approval for the sale of a large number of semiconductors to Saudi Arabia. It is currently unclear how many of these agreements are new and substantive, or merely indicate progress on agreements announced during President Trump's visit to Riyadh in May. Humain CEO Tareq Amin previously stated that he expects to obtain US-made AI chips when the first batch of data centers opens in early 2026.

- 18:38Data: If ETH falls below $2,991, the total long liquidation volume on major CEXs will reach $1.056 billions.According to ChainCatcher, citing Coinglass data, if ETH falls below $2,991, the cumulative long liquidation volume on major CEXs will reach $1.056 billion. Conversely, if ETH breaks above $3,299, the cumulative short liquidation volume on major CEXs will reach $405 million.