News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- The iShares Silver Trust (SLV) reflects investor psychology via the reflection effect, where risk preferences shift between gains and losses during market cycles. - Historical data (2008-2025) shows silver's mixed performance as a safe-haven asset, with 2008 (-8.7%) outperforming 2020 (-9%) due to diverging industrial vs. speculative demand. - SLV's volatility amplifies behavioral biases: panic selling during downturns (e.g., 11.6% drop in 2025) contrasts with speculative buying, creating liquidity-drive

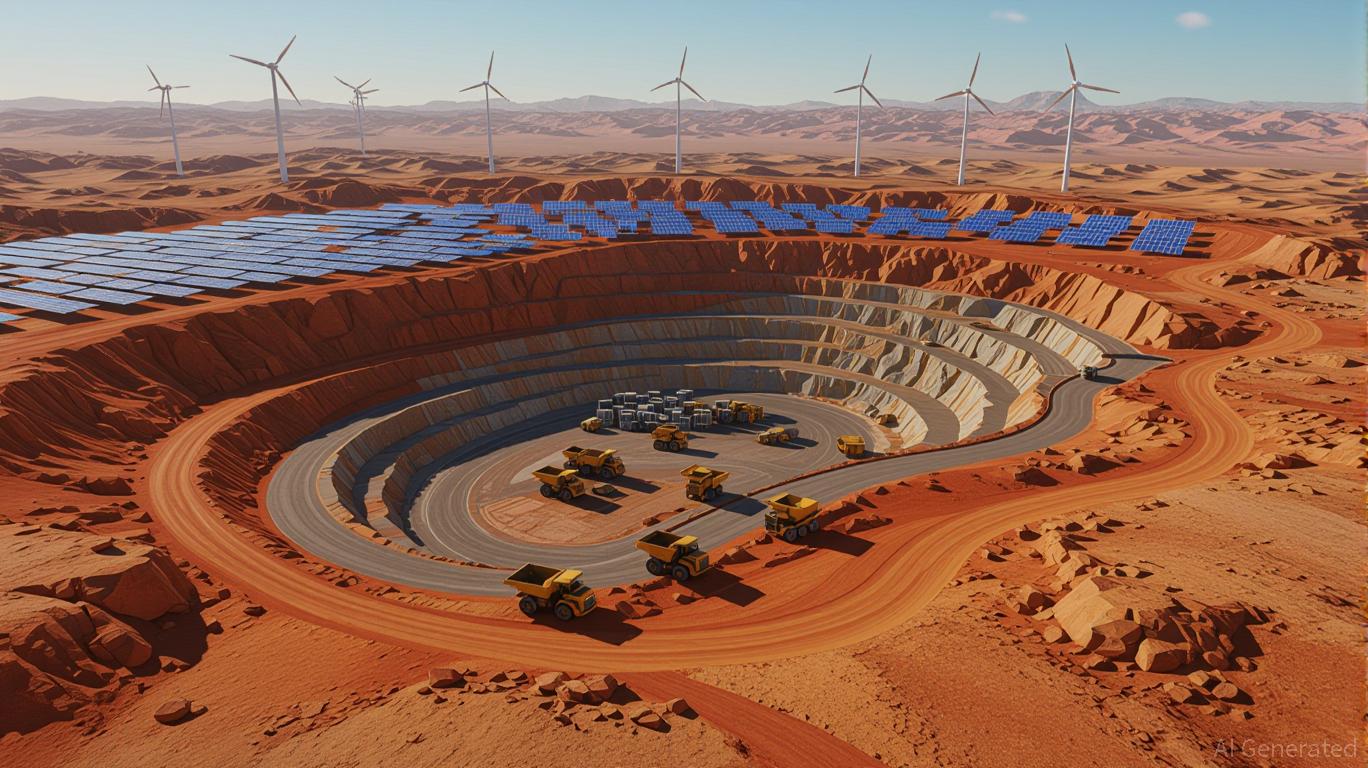

- Global copper markets face supply shocks from mine output drops (7% decline) and geopolitical tensions, while green energy transition drives structural demand growth. - EVs and renewables now account for 40% of demand, with clean energy use projected to triple by 2040, fueled by infrastructure policies in major economies. - Institutional investors adopt core-satellite strategies, allocating 50-60% to majors like BHP while targeting high-growth projects and using ETFs/derivatives for hedging. - Copper's u

- South Africa's shrinking platinum supply, driven by mine closures and strikes, creates a 2025 deficit of 966,000 ounces. - Hydrogen fuel cell adoption is boosting platinum demand, projected to grow from 40,000 to 900,000 ounces by 2030. - Platinum's dual role as an inflation hedge and energy transition enabler positions it as a strategic long-term investment. - Risks include South Africa's operational challenges and emerging catalyst alternatives, though platinum remains unmatched in efficiency.

- In 2025, GLD reflected behavioral economics principles as geopolitical tensions and macroeconomic volatility drove gold prices to $3,500/oz, fueled by U.S.-China trade disputes and Russia-Ukraine conflicts. - The reflection effect shaped investor behavior: risk-averse profit-taking during gains vs. risk-seeking doubling-down during losses, amplified by 397 tonnes of GLD inflows and central bank gold purchases (710 tonnes/qtr). - UBS projected 25.7% gold rebound by late 2025, emphasizing GLD's role as a s

- XRP's 2025 price dynamics reflect legal framework impacts, with civil law jurisdictions (France/Quebec) enabling 22% lower volatility and institutional adoption via MiCA/ARLPE regulations. - Behavioral biases like retail panic selling at $3.0890 and whale accumulation of 340M XRP (93% in profit) highlight divergent retail-institutional dynamics shaping price swings. - SEC's 2025 commodity reclassification and 11 spot ETF filings ($4.3-8.4B potential inflow) created self-reinforcing cycles of utility-driv

Japan’s FSA plans to regulate crypto under securities law, sparking debate over investor protection. Experts caution that extending this framework to failing IEOs could pose risks for retail investors.

Will the overlooked DeFi strong contender Fluid be listed on major exchanges soon?

Only additional income can bring true freedom.

People are speaking out not for self-custody or cypherpunk-style bitcoin discussions, but for political figures and financial engineering.

- 11:31Ethereum treasury company BitMine to conduct a registered direct offering of over $365 millionAccording to ChainCatcher, as reported by PR Newswire, Ethereum treasury company BitMine announced that it has reached an agreement with an institutional investor on a securities subscription agreement. The agreement involves the sale of approximately 5.22 million shares at a price of $70 per share in a registered direct offering transaction, as well as the sale of approximately 10.4 million warrants with an exercise price of $87.5. The company expects the total gross proceeds from this offering, before deducting placement agent fees and other estimated offering expenses, to be approximately $365.24 million. If all warrants are exercised for cash, the potential total gross proceeds in the future would be about $913 million. Adding the proceeds from the common stock issuance and the cash proceeds from the warrant exercises, the total gross proceeds would reach approximately $1.28 billion. The company expects this offering to be completed around September 23, 2025, subject to customary closing conditions. According to previous reports, BitMine disclosed that it currently holds more than 2% of the ETH token supply, with total assets reaching $11.4 billion.

- 11:31BitMine Immersion Technologies' total holdings value rises to $11.4 billionsChainCatcher news, BitMine Immersion Technologies (NYSE: BMNR), a Bitcoin and Ethereum network company focused on long-term investment in crypto assets, announced today that its total holdings of crypto assets + cash + "Moonshot Plan" have reached $11.4 billions. As of 4:00 PM Eastern Time on September 21, the company's crypto asset holdings include 2,416,054 ETH, 192 Bitcoin, $175 million worth of Eightco Holdings (Nasdaq: ORBS) equity ("Moonshot Plan" holdings), and $345 million in unrestricted cash. Last week, BitMine increased its holdings by 264,378 ETH.

- 11:05The 24-hour trading volume of DEXs on the BSC chain reached $4.258 billions, ranking first.According to Jinse Finance, data from DeFiLlama shows that DEXs on the BSC chain reached a 24-hour trading volume of $4.258 billions, surpassing Solana ($3.861 billions) to rank first.