News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 21) | U.S. September Nonfarm Payrolls Unexpectedly Increase by 119,000; BTC Falls Below $86,000, Crypto Market Sees $834M in Liquidations; OpenAI Launches ChatGPT Group Chat Feature Globally2Bitcoin slump to $86K brings BTC closer to ‘max pain’ but great ‘discount’ zone3Bitcoin, stocks crumble after Nvidia earnings and Fed uncertainty over next rate cut

It’s foolish to pretend Bitcoin’s story doesn’t include $79k this year

CryptoSlate·2025/11/14 19:00

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena.

深潮·2025/11/14 18:42

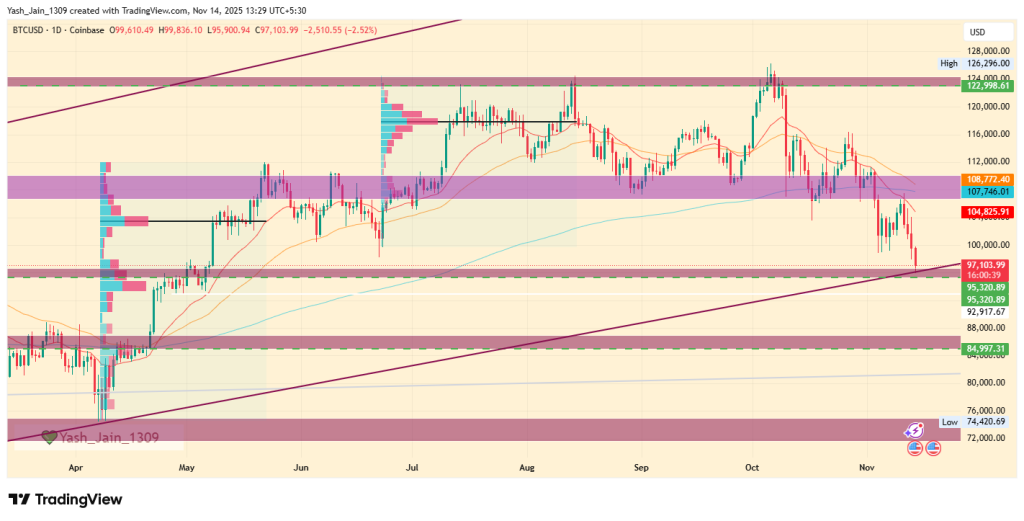

Comprehensive Data Analysis: BTC Falls Below the Critical $100,000 Level—Is the Bull Market Really Over?

Even if bitcoin is indeed in a bear market right now, this bear market may not last long.

深潮·2025/11/14 18:40

Options exchange Cboe enters the prediction market, focusing on financial and economic events

Options market leader Cboe has announced its entry into the prediction market. Rather than following the sports trend, it is firmly committed to a financially stable path and plans to launch its own products linked to financial outcomes and economic events.

深潮·2025/11/14 18:38

Grayscale formalizes its IPO filing

Cointribune·2025/11/14 18:06

Czech Bank Tests Crypto Assets In Pilot Program

Cointribune·2025/11/14 18:06

New XRP ETF Draws $58M Trading Volume, Tops This Year’s ETF Debuts

Cointribune·2025/11/14 18:06

Bitzuma Launches Research & Education Hub to Elevate Crypto Knowledge

DeFi Planet·2025/11/14 18:03

Bitcoin Price Prediction 2025, 2026 – 2030: How High Will BTC Price Go?

Coinpedia·2025/11/14 17:42

Why Crypto Is Down Today [Live] Updates On November 14,2025

Coinpedia·2025/11/14 17:42

Flash

- 08:15Lendep has passed the Certik audit and will continue to strengthen smart contract security.ChainCatcher News, lending platform Lendep announced that it has passed the Certik audit. In addition, the platform's total lending and deposit amount has exceeded 1.5 million US dollars. Lendep stated that it will continue to strengthen smart contract security, fund risk control, and transparency mechanisms. More asset markets and incentive mechanisms will be launched in the future to provide global users with more efficient and robust decentralized lending services.

- 07:56Analyst: Nakamoto transferred 1,003 BTC to Cobo as additional collateral for the previous $250 million financingAccording to ChainCatcher, analyst Emmett Gallic disclosed on the X platform that Arkham monitoring data shows that Bitcoin treasury company Nakamoto (formerly Kindly MD) has transferred 1,003 BTC to Cobo as collateral for its previous $250 million convertible bond financing. This is also the second time this week the company has added BTC collateral. At that time, the issuance price of this transaction was set at Bitcoin's all-time high of $124,000. As the market declines, margin pressure is evident, and close attention should be paid to the risks of excessive leverage.

- 07:56Galaxy Digital withdraws 7,098 ETH worth $19.42 million from an exchangeAccording to ChainCatcher, monitored by The Data Nerd, Galaxy Digital withdrew 7,098 ETH (approximately $19.42 million) from an exchange. Within one month, it has withdrawn a total of 14,096 ETH (about $44.12 million), with an average withdrawal amount of around $3,130 each time.